Question: Identify the major risks faced by the shaw communication inc and whether it hedges its risk exposures or not. This information is typically reported in

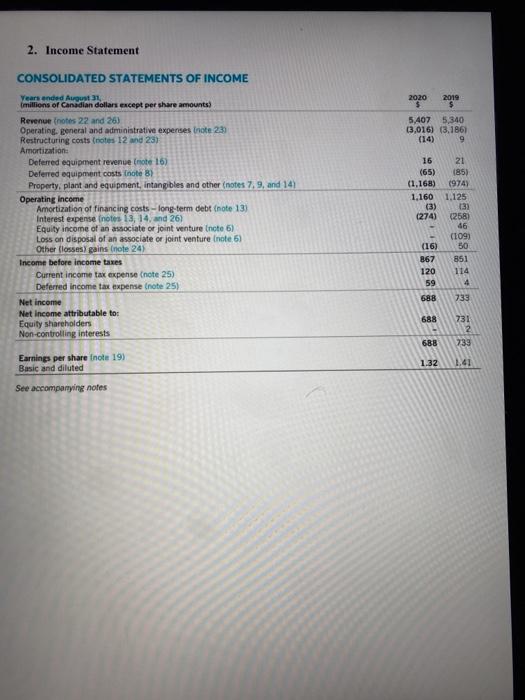

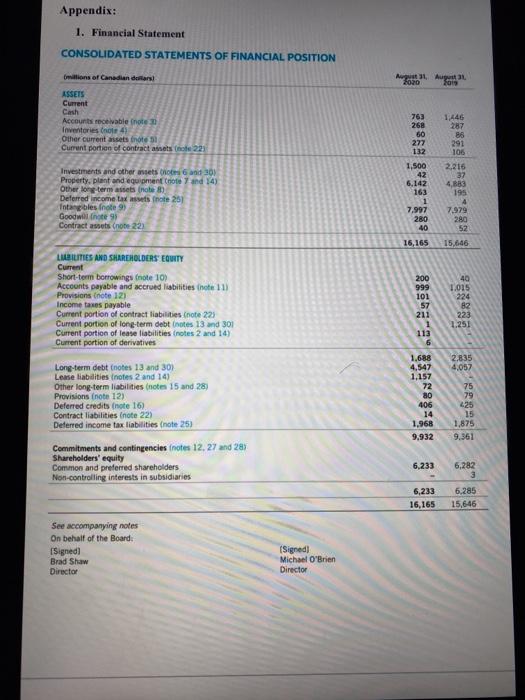

2. Income Statement 2020 2019 5,407 5,340 (3,016) (3,1861 (14) 9 CONSOLIDATED STATEMENTS OF INCOME Years ended August 31, millions of Canadian dollars except per share amounts) Revenue (notes 22 and 26) Operating general and administrative expenses Inote 2:37 Restructuring costs (notes 12 and 23) Amortization: Deferred equipment revenue (note 16) Deferred equipment costs (note B) Property, plant and equipment, intangibles and other (notes 7, 9, and 14) Operating Income Amortization of financing costs - long-term debt (note 13) Interest expense (notes 13, 14, and 26) Equity income of an associate or joint venture Inote 6) Loss on disposal of an associate or joint venture (note 6) Other (losses gains (note 24) Income before income taxes Current income tax expense note 25) Deferred income tax expense note 25) Net income Net Income attributable to Equity shareholders Non-controlling interests 16 (65) (1,168) 1.160 (3) (274) 21 185) (974) 1.125 32 (258) 46 (1091 50 851 114 4 (16) 867 120 59 688 733 688 731 2 733 688 1.32 1.41 Earnings per share Inote 19) Basic and diluted See accompanying notes Appendix: 1. Financial Statement CONSOLIDATED STATEMENTS OF FINANCIAL POSITION millions of Canadian dan 31 Aug 2020 09 ASSETS Current Cash Accounts receivable note Inventories no 4 Other current assets into Current portion of contract assets of 221 763 268 60 277 132 1446 287 86 291 106 2.216 37 4,883 195 Investments and other sets thon 6 and 301 Property, plant and equipment note 7 and 14) Other long terms assets robe Deferred income taxes note 251 Intangibles (note 93 Goodwill note 93 Contract assets (note 223 1,500 42 6.142 163 1 7.997 280 40 16,165 7.979 280 52 15,646 LIBILITIES AND SHAREHOLDERS' EQUITY Current Short-term borrowing note 10) Accounts payable and accrued liabilities hotell Provisions note 121 Income taxes payable Current portion of contract liabilities (note 223 Current portion of long-term debt totes 13 and 301 Current portion of lease liabilities (notes 2 and 14) Current portion of derivatives 200 999 101 57 211 1 113 6 40 1.015 224 82 223 1.251 2,835 4,057 Long-term debt notes 13 and 30) Lease liabilities (notes 2 and 14) Other long-term liabilities notes 15 and 28) Provisions (note 12) Deferred credits (note 16) Contract liabilities (note 22) Deferred income tax liabilities (note 25) 1.688 4,547 1,157 72 80 406 14 1,968 9,932 75 79 225 15 1,875 9,361 Commitments and contingencies notes 12. 27 and 28% Shareholders' equity Common and preferred shareholders Non-controlling interests in subsidiaries 6,233 6,282 3 6,233 16,165 6,285 15,646 See accompanying notes On behalf of the Board: Signed Brad Shaw Director (Signed! Michael O'Brien Director 2. Income Statement 2020 2019 5,407 5,340 (3,016) (3,1861 (14) 9 CONSOLIDATED STATEMENTS OF INCOME Years ended August 31, millions of Canadian dollars except per share amounts) Revenue (notes 22 and 26) Operating general and administrative expenses Inote 2:37 Restructuring costs (notes 12 and 23) Amortization: Deferred equipment revenue (note 16) Deferred equipment costs (note B) Property, plant and equipment, intangibles and other (notes 7, 9, and 14) Operating Income Amortization of financing costs - long-term debt (note 13) Interest expense (notes 13, 14, and 26) Equity income of an associate or joint venture Inote 6) Loss on disposal of an associate or joint venture (note 6) Other (losses gains (note 24) Income before income taxes Current income tax expense note 25) Deferred income tax expense note 25) Net income Net Income attributable to Equity shareholders Non-controlling interests 16 (65) (1,168) 1.160 (3) (274) 21 185) (974) 1.125 32 (258) 46 (1091 50 851 114 4 (16) 867 120 59 688 733 688 731 2 733 688 1.32 1.41 Earnings per share Inote 19) Basic and diluted See accompanying notes Appendix: 1. Financial Statement CONSOLIDATED STATEMENTS OF FINANCIAL POSITION millions of Canadian dan 31 Aug 2020 09 ASSETS Current Cash Accounts receivable note Inventories no 4 Other current assets into Current portion of contract assets of 221 763 268 60 277 132 1446 287 86 291 106 2.216 37 4,883 195 Investments and other sets thon 6 and 301 Property, plant and equipment note 7 and 14) Other long terms assets robe Deferred income taxes note 251 Intangibles (note 93 Goodwill note 93 Contract assets (note 223 1,500 42 6.142 163 1 7.997 280 40 16,165 7.979 280 52 15,646 LIBILITIES AND SHAREHOLDERS' EQUITY Current Short-term borrowing note 10) Accounts payable and accrued liabilities hotell Provisions note 121 Income taxes payable Current portion of contract liabilities (note 223 Current portion of long-term debt totes 13 and 301 Current portion of lease liabilities (notes 2 and 14) Current portion of derivatives 200 999 101 57 211 1 113 6 40 1.015 224 82 223 1.251 2,835 4,057 Long-term debt notes 13 and 30) Lease liabilities (notes 2 and 14) Other long-term liabilities notes 15 and 28) Provisions (note 12) Deferred credits (note 16) Contract liabilities (note 22) Deferred income tax liabilities (note 25) 1.688 4,547 1,157 72 80 406 14 1,968 9,932 75 79 225 15 1,875 9,361 Commitments and contingencies notes 12. 27 and 28% Shareholders' equity Common and preferred shareholders Non-controlling interests in subsidiaries 6,233 6,282 3 6,233 16,165 6,285 15,646 See accompanying notes On behalf of the Board: Signed Brad Shaw Director (Signed! Michael O'Brien Director

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts