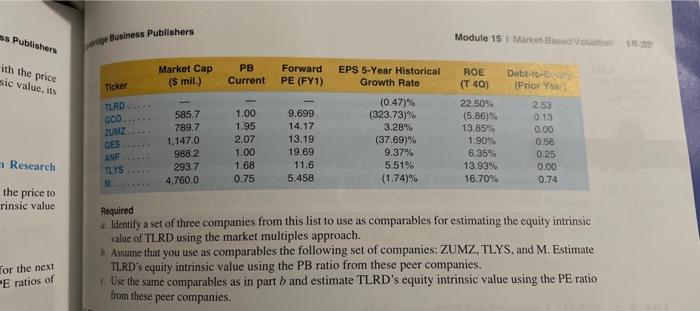

Question: Identifying Comparables and Valuation Using PB and PE Tailored Brands Inc,'s book value of equity is $4.563 million and its forward eamings ecthese share is

Identifying Comparables and Valuation Using PB and PE Tailored Brands Inc,'s book value of equity is $4.563 million and its forward eamings ecthese share is $1.10, or $55.7 million in total earnings. The following information is also available for Tuev and a peer group of companies (identified by ticker symbol) from the specialty retail sector. Required 7. Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of TLRD using the market multiples approach. h Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD's equity intrinsic value using the PB ratio from these peer companies. is Use the same comparables as in part b and estimate TLRD's equity intrinsic value using the PE ratio from these peer companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts