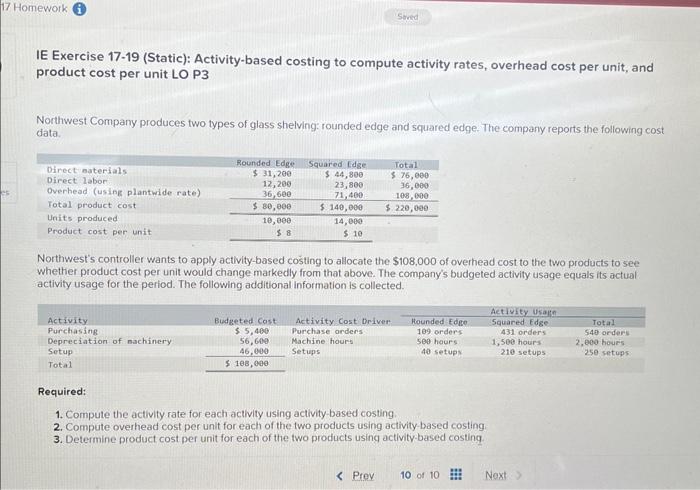

Question: IE Exercise 17-19 (Static): Activity-based costing to compute activity rates, overhead cost per unit, and product cost per unit LO P3 Northwest Company produces two

IE Exercise 17-19 (Static): Activity-based costing to compute activity rates, overhead cost per unit, and product cost per unit LO P3 Northwest Company produces two types of glass shelving: rounded edge and squared edge. The company reports the following cast data. Northwest's controller wants to apply activity-based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Required: 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity-based costing. 3. Determine product cost per unit for each of the two products using activity-based costing. 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity-based costing. 3. Determine product cost per unit for each of the two products using activity-based costing. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts