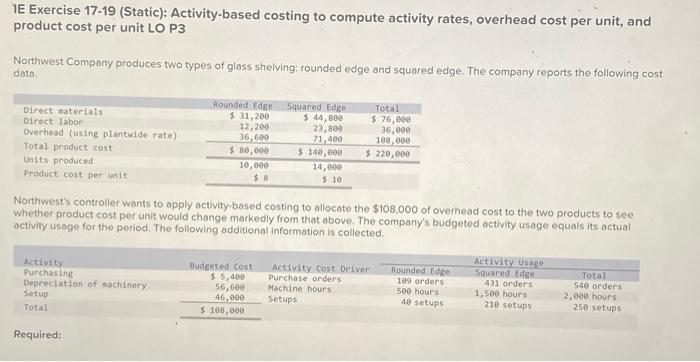

Question: 1E Exercise 17-19 (Static): Activity-based costing to compute activity rates, overhead cost per unit, and product cost per unit LO P3 Northwest Company produces two

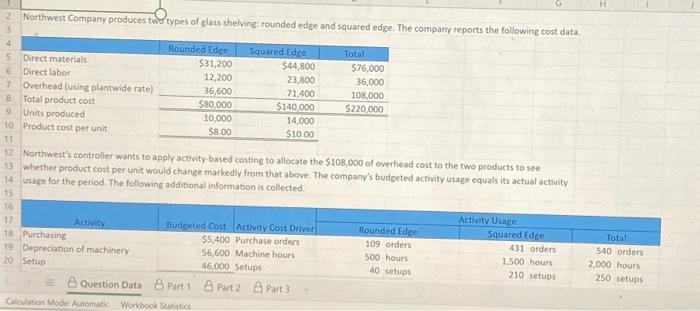

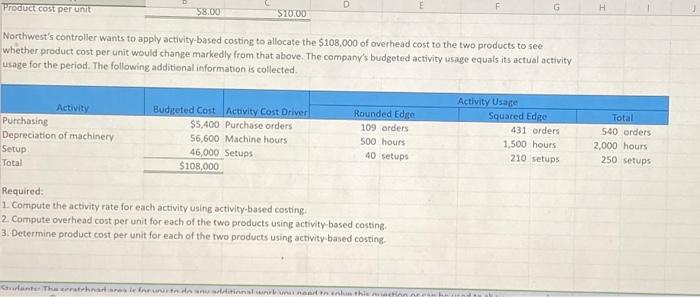

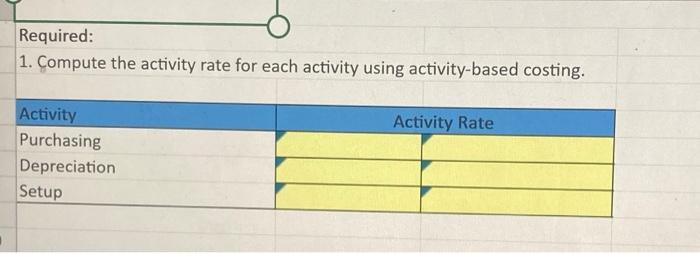

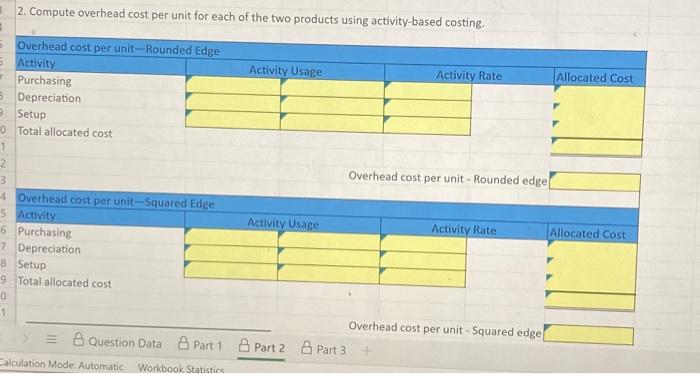

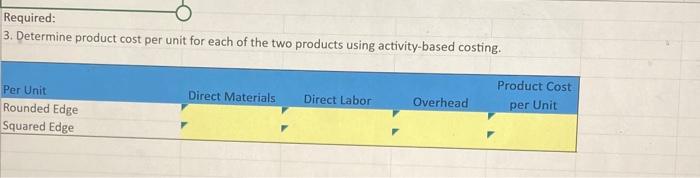

1E Exercise 17-19 (Static): Activity-based costing to compute activity rates, overhead cost per unit, and product cost per unit LO P3 Northwest Company produces two types of glass shelving: rounded edge and squared edge. The company reports the following cos data Northwest's controller wants to apply activity-based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual octivity usage for the period. The following additional information is collected. Required: Northwest Company produces twt types of glass shelving: rounded edge and squared edge. The company reports the following cost data. Northwet's controller wants to apply activity based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markediy from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Northwest's controller wants to apply activity-based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Required: 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity based costing: 3. Determine product cost per unit for each of the two products using activity based costing- 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity-based costing- 3. Determine product cost per unit for each of the two products using activity-based costing. 1E Exercise 17-19 (Static): Activity-based costing to compute activity rates, overhead cost per unit, and product cost per unit LO P3 Northwest Company produces two types of glass shelving: rounded edge and squared edge. The company reports the following cos data Northwest's controller wants to apply activity-based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual octivity usage for the period. The following additional information is collected. Required: Northwest Company produces twt types of glass shelving: rounded edge and squared edge. The company reports the following cost data. Northwet's controller wants to apply activity based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markediy from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Northwest's controller wants to apply activity-based costing to allocate the $108,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following additional information is collected. Required: 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity based costing: 3. Determine product cost per unit for each of the two products using activity based costing- 1. Compute the activity rate for each activity using activity-based costing. 2. Compute overhead cost per unit for each of the two products using activity-based costing- 3. Determine product cost per unit for each of the two products using activity-based costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts