Question: If , 4. Consider the forward exchange rate between the US dollars and the euro is denoted by with maturity T years. Suppose that the

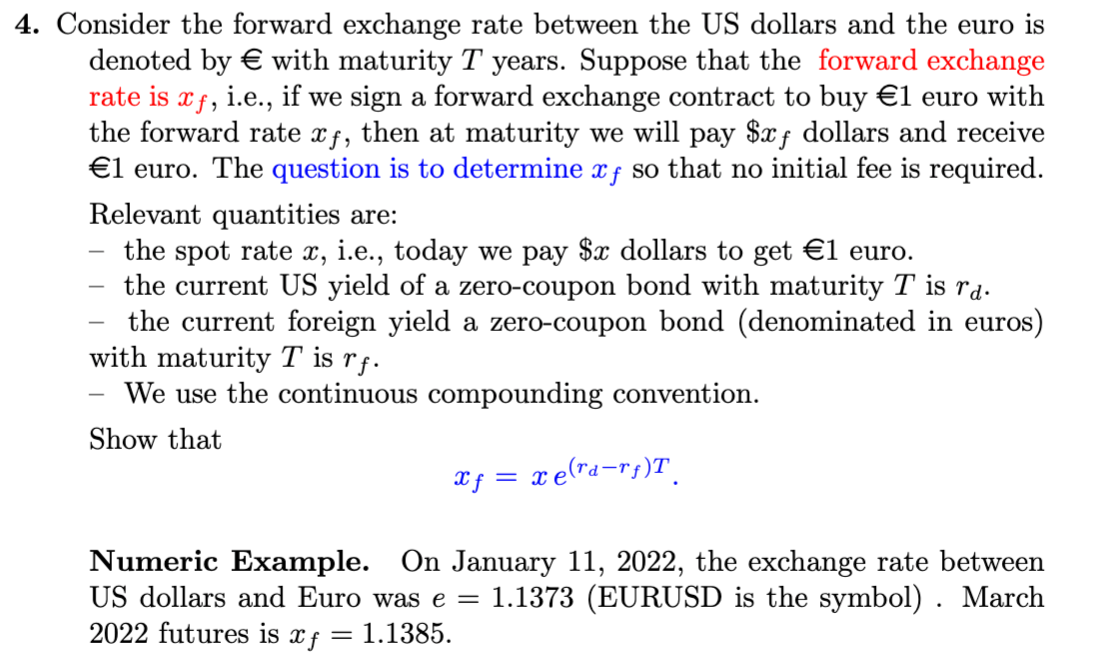

If , 4. Consider the forward exchange rate between the US dollars and the euro is denoted by with maturity T years. Suppose that the forward exchange rate is Xf, i.e., if we sign a forward exchange contract to buy 1 euro with the forward rate then at maturity we will pay $x f dollars and receive 1 euro. The question is to determine xf so that no initial fee is required. Relevant quantities are: the spot rate x, i.e., today we pay $x dollars to get 1 euro. the current US yield of a zero-coupon bond with maturity T is rd. the current foreign yield a zero-coupon bond (denominated in euros) with maturity T is rf. We use the continuous compounding convention. Show that X f = x elva-rf)7. Numeric Example. On January 11, 2022, the exchange rate between US dollars and Euro was e = 1.1373 (EURUSD is the symbol) . March 2022 futures is Xf 1.1385. = If , 4. Consider the forward exchange rate between the US dollars and the euro is denoted by with maturity T years. Suppose that the forward exchange rate is Xf, i.e., if we sign a forward exchange contract to buy 1 euro with the forward rate then at maturity we will pay $x f dollars and receive 1 euro. The question is to determine xf so that no initial fee is required. Relevant quantities are: the spot rate x, i.e., today we pay $x dollars to get 1 euro. the current US yield of a zero-coupon bond with maturity T is rd. the current foreign yield a zero-coupon bond (denominated in euros) with maturity T is rf. We use the continuous compounding convention. Show that X f = x elva-rf)7. Numeric Example. On January 11, 2022, the exchange rate between US dollars and Euro was e = 1.1373 (EURUSD is the symbol) . March 2022 futures is Xf 1.1385. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts