Question: If a bond is called at 103.75, how much will an investor receive? A. $1,037.50 plus accrued interest B. $1,037.50 C. $1,037.75 D. It depends

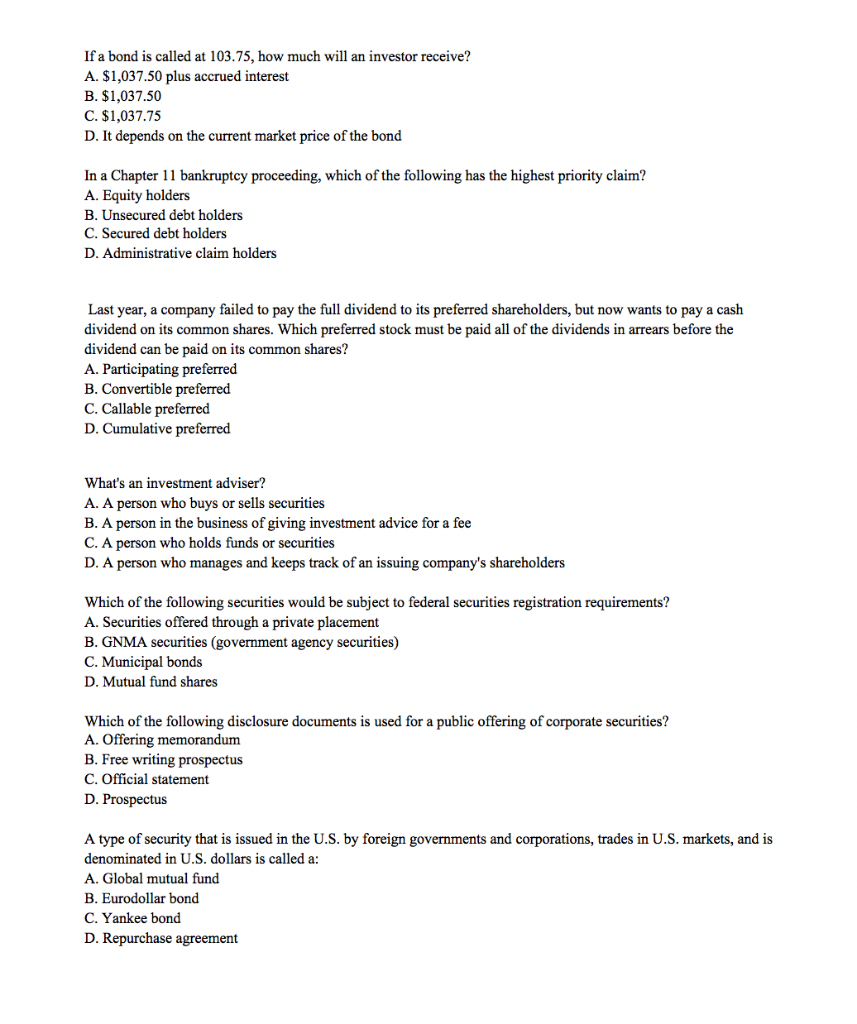

If a bond is called at 103.75, how much will an investor receive? A. $1,037.50 plus accrued interest B. $1,037.50 C. $1,037.75 D. It depends on the current market price of the bond In a Chapter 11 bankruptcy proceeding, which of the following has the highest priority claim? A. Equity holders B. Unsecured debt holders C. Secured debt holders D. Administrative claim holders Last year, a company failed to pay the full dividend to its preferred shareholders, but now wants to pay a cash dividend on its common shares. Which preferred stock must be paid all of the dividends in arrears before the dividend can be paid on its common shares? A. Participating preferred B. Convertible preferred C. Callable preferred D. Cumulative preferred What's an investment adviser? A. A person who buys or sells securities B. A person in the business of giving investment advice for a fee C. A person who holds funds or securities D. A person who manages and keeps track of an issuing company's shareholders Which of the following securities would be subject to federal securities registration requirements? A. Securities offered through a private placement B. GNMA securities (government agency securities) C. Municipal bonds D. Mutual fund shares Which of the following disclosure documents is used for a public offering of corporate securities? A. Offering memorandum B. Free writing prospectus C. Official statement D. Prospectus A type of security that is issued in the U.S. by foreign governments and corporations, trades in U.S. markets, and is denominated in U.S. dollars is called a: A. Global mutual fund B. Eurodollar bond C. Yankee bond D. Repurchase agreement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts