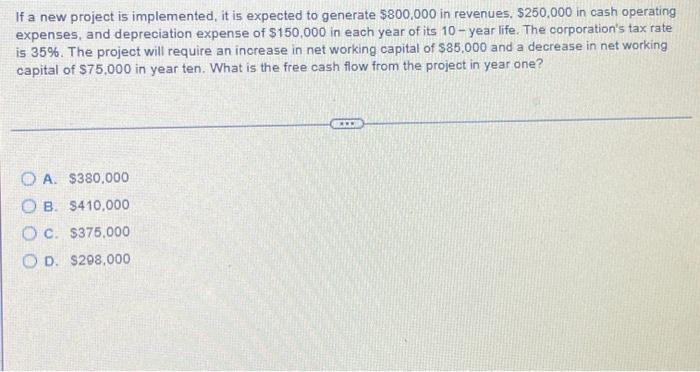

Question: If a new project is implemented, it is expected to generate $800,000 in revenues. $250,000 in cash operating expenses, and depreciation expense of $150,000 in

If a new project is implemented, it is expected to generate $800,000 in revenues. $250,000 in cash operating expenses, and depreciation expense of $150,000 in each year of its 10-year life. The corporation's tax rate is 35%. The project will require an increase in net working capital of $85.000 and a decrease in net working capital of $75,000 in year ten. What is the free cash flow from the project in year one? OA. $380,000 OB. $410,000 O c. $375,000 OD. $298,000 www

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts