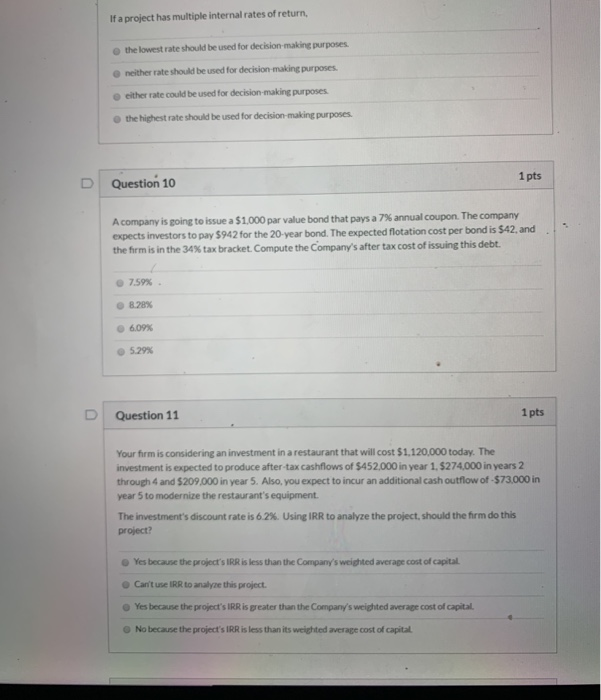

Question: If a project has multiple internal rates of return, the lowest rate should be used for decision-making purposes neither rate should be used for decision-making

If a project has multiple internal rates of return, the lowest rate should be used for decision-making purposes neither rate should be used for decision-making purposes either rate could be used for decision-making purposes e the highest rate should be used for decision-making purposes 1 pts Question 10 D A company is going to issue a $1,000 par value bond that pays a 7 % annual coupon. The company expects investors to pay $942 for the 20-year bond. The expected flotation cost per bond is $42, and the firm is in the 34 % tax bracket. Compute the Company's after tax cost of issuing this debt. 7.59 % 8.28% 6.09 % 529 % 1 pts D Question 11 Your firm is considering an investment in a restaurant that will cost $1,120,000 today. The investment is expected to produce after-tax cashflows of $452,000 in year 1, $274,000 in years 2 through 4 and $209,000 in year 5. Also, you expect to incur an additional cash outflow of -$73,000 in year 5 to modernize the restaurant's equipment. The investment's discount rate is 6.2 %. Using IRR to analyze the project, should the firm do this project? Yes because the project's IRR is less than the Company's weighted average cost of capital e Can't use IRR to analyze this project. Yes because the project's IRR is greater than the Company's weighted average cost of capital. ONo because the project's IRR is less than its weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts