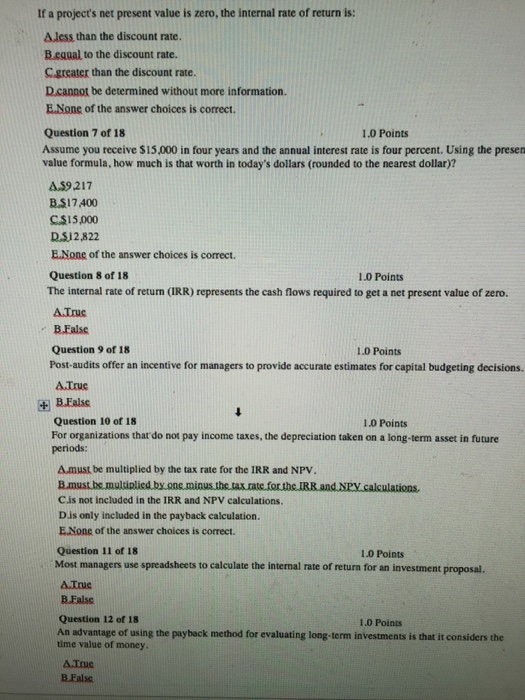

Question: If a project's net present value is zero, the internal rate of return is: A. less than the discount rate. B. equal to the discount

If a project's net present value is zero, the internal rate of return is: A. less than the discount rate. B. equal to the discount rate. C. greater than the discount rate. D. cannot be determined without more information. E. None of the answer choices is correct. Assume you receive $15,000 in four years and the annual interest rate is four percent. Using the present value formula, how much is that worth in today's dollars (rounded to the nearest dollar)? A. $9, 217 B. $17, 400 C. $15,000 D. $12, 822 E. None of the answer choices is correct. The internal rate of return (IRR) represents the cash flows required to get a net present value of zero. A. True B. False Post-audits offer an incentive for managers to provide accurate estimates for capital budgeting decisions. A. True B. False For organizations that do not pay income taxes, the depreciation taken on a long-term asset in future periods: A. must be multiplied by the tax rate for the IRR and NPV. B. must be multiplied by one minus the tax rate for the IRR and NPV calculations. C. is not included in the IRR and NPV calculations. D. is only included in the payback calculation. E. None of the answer choices is correct. Most managers use spreadsheets to calculate the internal rate of return for an investment proposal. A. True B. False An advantage of using the payback method for evaluating long-term investments is that it considers the time value of money. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts