Question: If a U . S . citizen returns from anywhere other than a U . S , Insular possession ( U . S . Virgin

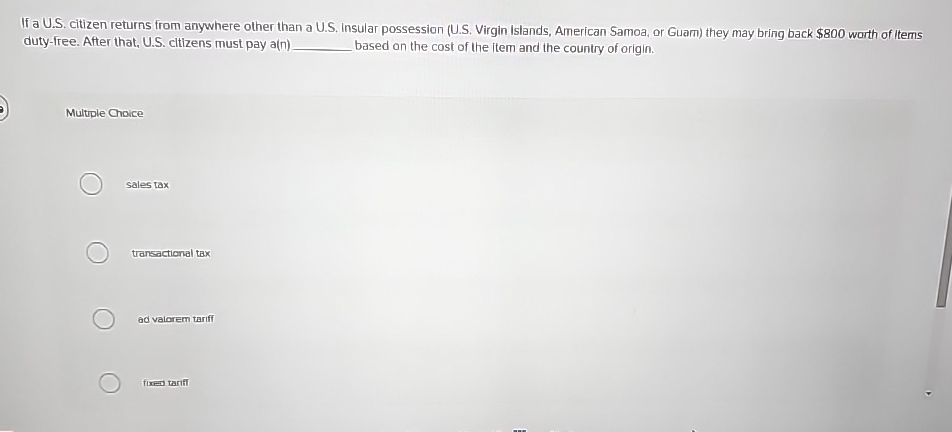

If a US citizen returns from anywhere other than a US Insular possession US Virgin Islands, American Samoa, or Guam they may bring back $ warth of Items dutyfree. After that, US cltizens must pay an based on the cost of the Item and the country of origin.

Multiple Choice

sales tax

transactional tax

ad valorem tariff

fix tart

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock