Question: If an employee paid by commission does not complete a TD 1 X and / or a TP - 1 0 1 5 . R

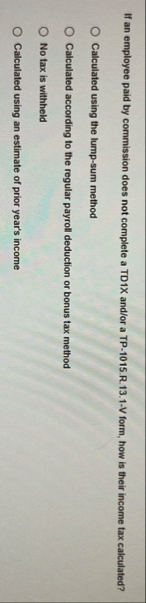

If an employee paid by commission does not complete a TDX andor a TPRV form, how is their income tax calculated?

Calculated using the lumpsum method

Calculated according to the regular payroll deduction or bonus tax method

No tax is withheld

Calculated using an estimate of prior year's income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock