Question: if any unclear i can require single picture.please help. first picture is requiressecond one is questionslast two is fixed cost and labour 2 D2 2

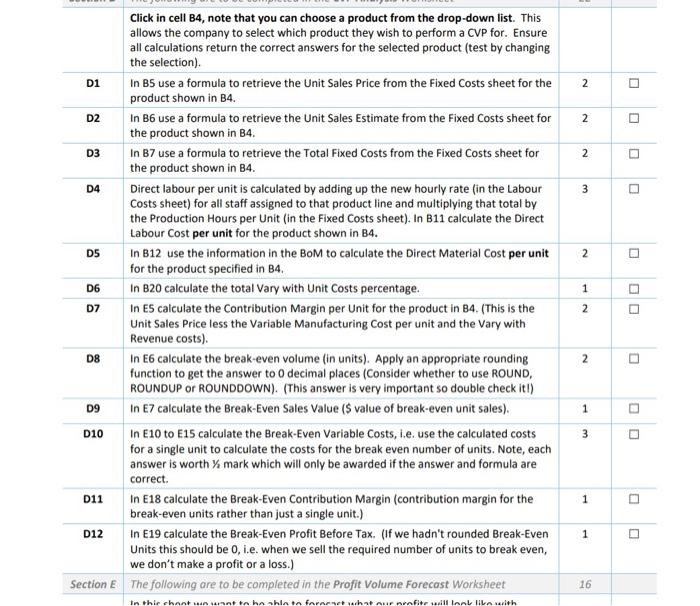

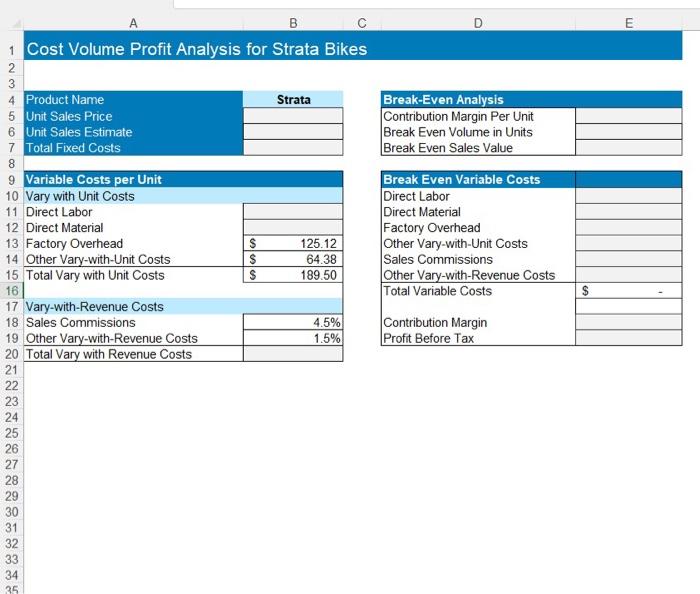

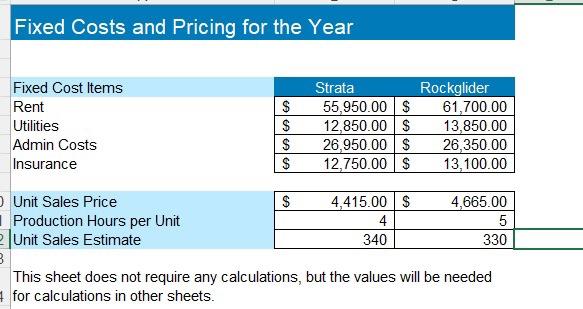

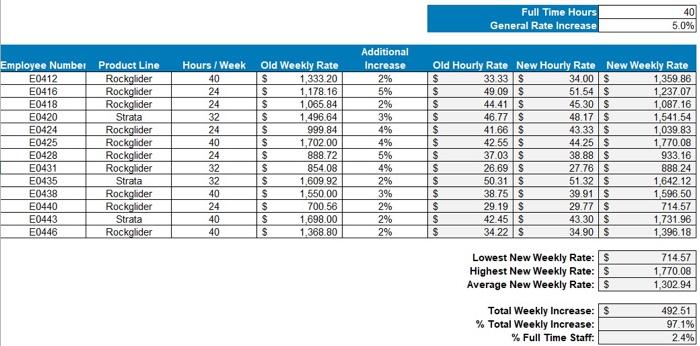

2 D2 2 2 3 D5 2 D6 1 O Click in cell B4, note that you can choose a product from the drop-down list. This allows the company to select which product they wish to perform a CVP for. Ensure all calculations return the correct answers for the selected product (test by changing the selection). D1 In BS use a formula to retrieve the Unit Sales Price from the Fixed Costs sheet for the product shown in B4 In B6 use a formula to retrieve the Unit Sales Estimate from the Fixed Costs sheet for the product shown in B4. D3 in B7 use a formula to retrieve the Total Fixed Costs from the Fixed Costs sheet for the product shown in B4. D4 Direct labour per unit is calculated by adding up the new hourly rate (in the Labour Costs sheet) for all staff assigned to that product line and multiplying that total by the Production Hours per Unit (in the Fixed Costs sheet). In B11 calculate the Direct Labour Cost per unit for the product shown in B4. In B12 use the information in the BoM to calculate the Direct Material Cost per unit for the product specified in B4. In B20 calculate the total vary with Unit Costs percentage. In Es calculate the Contribution Margin per Unit for the product in B4. (This is the Unit Sales Price less the Variable Manufacturing Cost per unit and the Vary with Revenue costs) D8 In E6 calculate the break-even volume (in units). Apply an appropriate rounding function to get the answer to decimal places (Consider whether to use ROUND, ROUNDUP or ROUNDDOWN). (This answer is very important so double check it!) D9 In E7 calculate the Break-even Sales Value ($value of break-even unit sales). 010 In E10 to E15 calculate the Break-even Variable Costs, i.e. use the calculated costs for a single unit to calculate the costs for the break even number of units. Note, each answer is worth X mark which will only be awarded if the answer and formula are correct D11 In E18 calculate the Break-Even Contribution Margin (contribution margin for the break-even units rather than just a single unit.) D12 In E19 calculate the Break-Even Profit Before Tax. (If we hadn't rounded Break-even Units this should be 0. i.e. when we sell the required number of units to break even, we don't make a profit or a loss.) Section E The following are to be completed in the Profit Volume Forecast Worksheet D7 2 N 2 1 3 1 1 1 16 In this chant want the shinta fararstwachat aur rofit all Il lile with B D E Break-Even Analysis Contribution Margin Per Unit Break Even Volume in Units Break Even Sales Value Break Even Variable Costs Direct Labor Direct Material Factory Overhead Other Vary-with-Unit Costs Sales Commissions Other Vary-with-Revenue Costs Total Variable Costs $ 1 Cost Volume Profit Analysis for Strata Bikes 2 3 4 Product Name Strata 5 Unit Sales Price 6 Unit Sales Estimate 7 Total Fixed Costs 8 9 Variable Costs per Unit 10 Vary with Unit Costs 11 Direct Labor 12 Direct Material 13 Factory Overhead $ 125.12 14 Other Vary-with-Unit Costs $ 64.38 15 Total Vary with Unit Costs $ 189.50 16 17 Vary-with-Revenue Costs 18 Sales Commissions 4.5% 19 Other Vary-with-Revenue Costs 1.5% 20 Total Vary with Revenue Costs 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Contribution Margin Profit Before Tax 35 Fixed Costs and Pricing for the Year Fixed Cost Items Rent Utilities Admin Costs Insurance GAAGAA $ $ $ $ Strata 55,950.00 $ 12,850.00 $ 26,950.00 $ 12,750.00 $ Rockglider 61,700.00 13,850.00 26,350.00 13,100.00 Unit Sales Price $ 4,415.00$ 4,665.00 Production Hours per Unit 4 5 Unit Sales Estimate 340 330 3 This sheet does not require any calculations, but the values will be needed for calculations in other sheets. Full Time Hours General Rate Increase 40 5.0% Employee Number Product Line E0412 Rockglider E0416 Rockglider E0418 Rockglider E0420 Strata E0424 Rockglider E0425 Rockglider E0428 Rockglider E0431 Rockglider E0435 Strata E0438 Rockglider E0440 Rockglider E0443 Strata E0446 Rockglider Hours/Week 40 24 24 32 24 40 24 32 32 40 24 40 40 Old Weekly Rate $ 1,333 20 $ 1.178.16 $ 1.065.84 $ 1.496.64 $ 999.84 $ 1,702.00 $ 888.72 $ 854.08 $ 1,609 92 $ 1,550 00 $ 700.56 $ 1.698.00 $ 1,368 80 Additional Increase 2% 5% 2% 3% 4% 4% 5% 4% Old Hourly Rate New Hourly Rate New Weekly Rate $ 33.33 $ 34.00 $ 1 359 86 $ 49.09S 51.54 $ 1237 07 $ 44.41 $ 45.30S 1.087.16 $ 46.77S 48.17$ 1,541.54 $ 41.66 $ 43.33 $ 1,039.83 $ 42.55$ 44.25$ 1,770.08 $ 37.03 $ 38.88 $ 933.16 $ 26.69S 27.76 $ 888 24 $ 50 315 51.32 $ 1.642.12 $ 38.75$ 39.91 $ 1,596 50 $ 29.19 $ 29.77 $ 714.57 $ 42.45 $ 43.30 $ 1.731.96 $ 34 22 S 34.90 $ 1,396.18 2% 3% 2% 2% 2% Lowest New Weekly Rate: $ Highest New Weekly Rate: $ Average New Weekly Rate: S 714.57 1,770.08 1,302.94 Total Weekly Increase: $ % Total Weekly Increase: % Full Time Staff: 492.51 97.1% 2.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts