Question: If Cold Storage opted for Alternative 2, compute the hedging cost and the amount that it would need to pay in MYR, assuming the spot

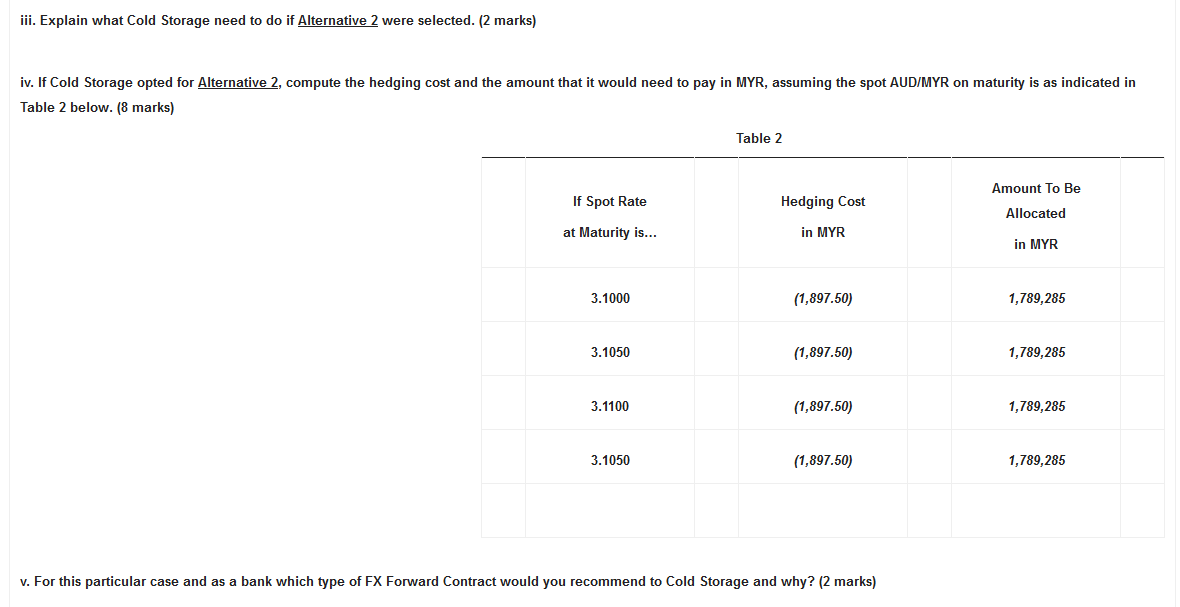

If Cold Storage opted for Alternative 2, compute the hedging cost and the amount that it would need to pay in MYR, assuming the spot AUD/MYR on maturity is as indicated in Table 2 below. (8 marks) Table 2 If Spot Rate at Maturity is Hedging Cost in MYR Amount To Be Allocated in MYR 3.1000 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 3.1100 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 v. For this particular case and as a bank which type of FX Forward Contract would you recommend to Cold Storage and why? (2 marks)

If Cold Storage opted for Alternative 2, compute the hedging cost and the amount that it would need to pay in MYR, assuming the spot AUD/MYR on maturity is as indicated in Table 2 below. (8 marks) Table 2 If Spot Rate at Maturity is Hedging Cost in MYR Amount To Be Allocated in MYR 3.1000 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 3.1100 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 v. For this particular case and as a bank which type of FX Forward Contract would you recommend to Cold Storage and why? (2 marks)

iii. Explain what Cold Storage need to do if Alternative 2 were selected. (2 marks) iv. If Cold Storage opted for Alternative 2, compute the hedging cost and the amount that it would need to pay in MYR, assuming the spot AUD/MYR on maturity is as indicated in Table 2 below. (8 marks) Table 2 Amount To Be If Spot Rate Hedging Cost Allocated at Maturity is... in MYR in MYR 3.1000 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 3.1100 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 v. For this particular case and as a bank which type of FX Forward Contract would you recommend to Cold Storage and why? (2 marks) iii. Explain what Cold Storage need to do if Alternative 2 were selected. (2 marks) iv. If Cold Storage opted for Alternative 2, compute the hedging cost and the amount that it would need to pay in MYR, assuming the spot AUD/MYR on maturity is as indicated in Table 2 below. (8 marks) Table 2 Amount To Be If Spot Rate Hedging Cost Allocated at Maturity is... in MYR in MYR 3.1000 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 3.1100 (1,897.50) 1,789,285 3.1050 (1,897.50) 1,789,285 v. For this particular case and as a bank which type of FX Forward Contract would you recommend to Cold Storage and why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts