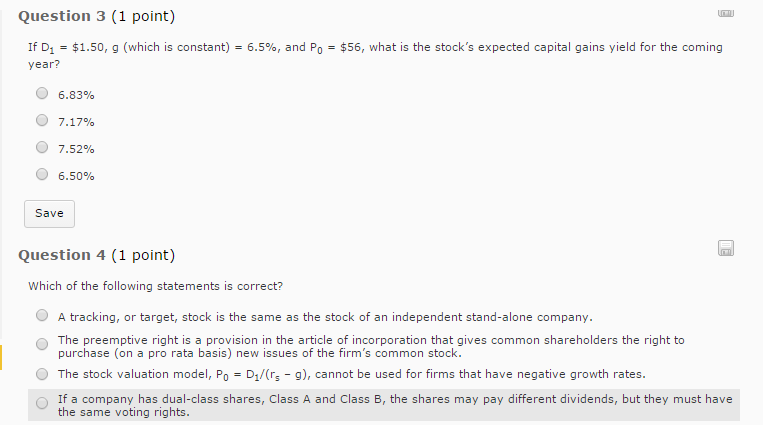

Question: If D_1 = $1.50, g (which is constant) = 6.5%, and P_0 = $56, what is the stock's expected capital gains yield for the coming

If D_1 = $1.50, g (which is constant) = 6.5%, and P_0 = $56, what is the stock's expected capital gains yield for the coming year? 6.83% 7.17% 7.52% 6.50% Which of the following statements is correct? A tracking, or target, stock is the same as the stock of an independent stand-alone company. The preemptive right is a provision in the article of incorporation that gives common shareholders the right to purchase (on a pro rata basis) new issues of the firm's common stock. The stock valuation model, P_0 - D_1/(r_s - g), cannot be used for firms that have negative growth rates. If a company has dual-class shares, Class A and Class B, the shares may pay different dividends, but they must have the same voting rights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts