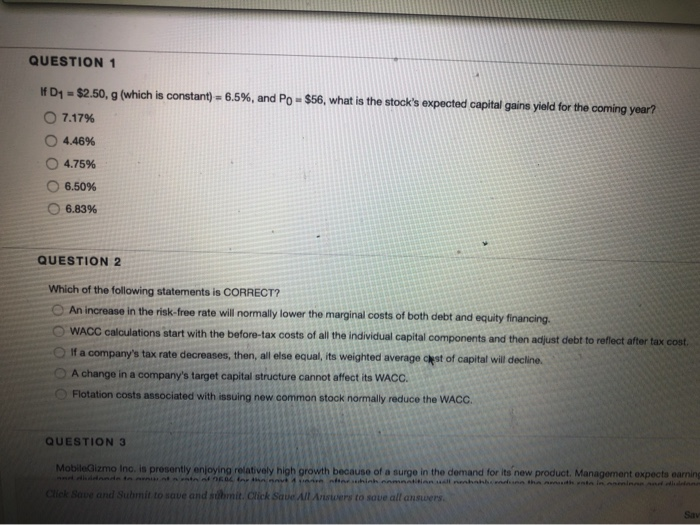

Question: QUESTION 1 If D1 = $2.50. g (which is constant) = 6.5%, and Po-$56, what is the stock's expected capital gains yield for the coming

QUESTION 1 If D1 = $2.50. g (which is constant) = 6.5%, and Po-$56, what is the stock's expected capital gains yield for the coming year? O 7.17% 4.46% 4.75% 6.50% 6.83% QUESTION 2 Which of the following statements is CORRECT? An increase in the risk-free rate will normally lower the marginal costs of both debt and equity financing. WACC calculations start with the before-tax costs of all the individual capital components and then adjust debt to reflect after tax cost If a company's tax rate decreases, then, all else equal, its weighted average cost of capital will decline A change in a company's target capital structure cannot affect its WACC. Flotation costs associated with issuing new common stock normally reduce the WACC QUESTION 3 MobileGizmo Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product Management expects earning Click Save and Submit to save and submit. Click Save All Answers to save all answers QUESTION 1 If D1 = $2.50, 9 (which is constant) = 6. 7.17% O 4.46% 0 4.75% O 6.50% 0 6.83% QUESTION 2 Which of the following statements is COR An increase in the risk-free rate will no WACC calculations start with the befo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts