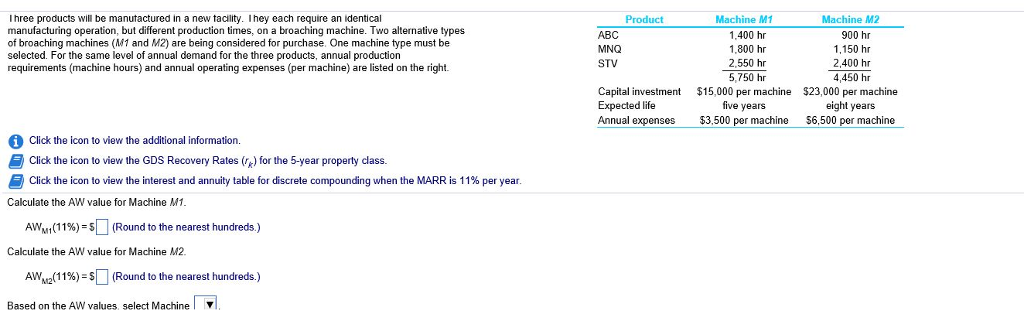

Question: ?IF EXCEL IS USED PLEASE EXPLAIN STEPS More Info Assumptions: The facility will operate 2,200 hours per year. Machine availability is 85% for Machine M1

?IF EXCEL IS USED PLEASE EXPLAIN STEPS

?IF EXCEL IS USED PLEASE EXPLAIN STEPS

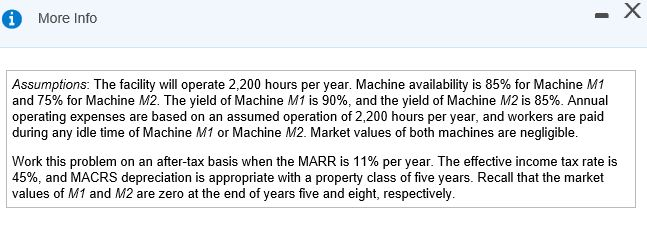

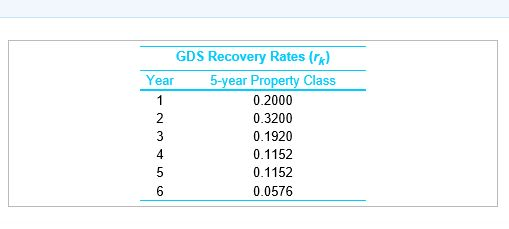

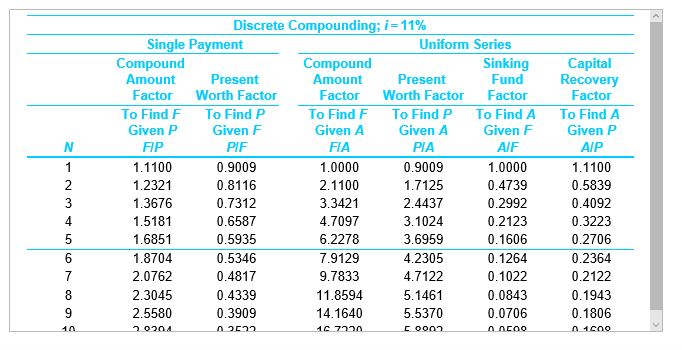

More Info Assumptions: The facility will operate 2,200 hours per year. Machine availability is 85% for Machine M1 and 75% for Machine M2. The yield of Machine M1 is 90%, and the yield of Machine M2 is 85%. Annual operating expenses are based on an assumed operation of 2,200 hours per year, and workers are paid during any idle time of Machine M1 or Machine M2. Market values of both machines are negligible. work this problem on an after-tax basis when the MARR is 11% per year. The effective income tax rate is 45%, and MACRS depreciation is appropriate with a property class of five years. Recall that the market values of M1 and M2 are zero at the end of years five and eight, respectively More Info Assumptions: The facility will operate 2,200 hours per year. Machine availability is 85% for Machine M1 and 75% for Machine M2. The yield of Machine M1 is 90%, and the yield of Machine M2 is 85%. Annual operating expenses are based on an assumed operation of 2,200 hours per year, and workers are paid during any idle time of Machine M1 or Machine M2. Market values of both machines are negligible. work this problem on an after-tax basis when the MARR is 11% per year. The effective income tax rate is 45%, and MACRS depreciation is appropriate with a property class of five years. Recall that the market values of M1 and M2 are zero at the end of years five and eight, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts