Question: If excel is used, please post formulas, will rate thank you! Can explain in full details, must show steps thanks! A firm is considering purchasing

If excel is used, please post formulas, will rate thank you! Can explain in full details, must show steps thanks!

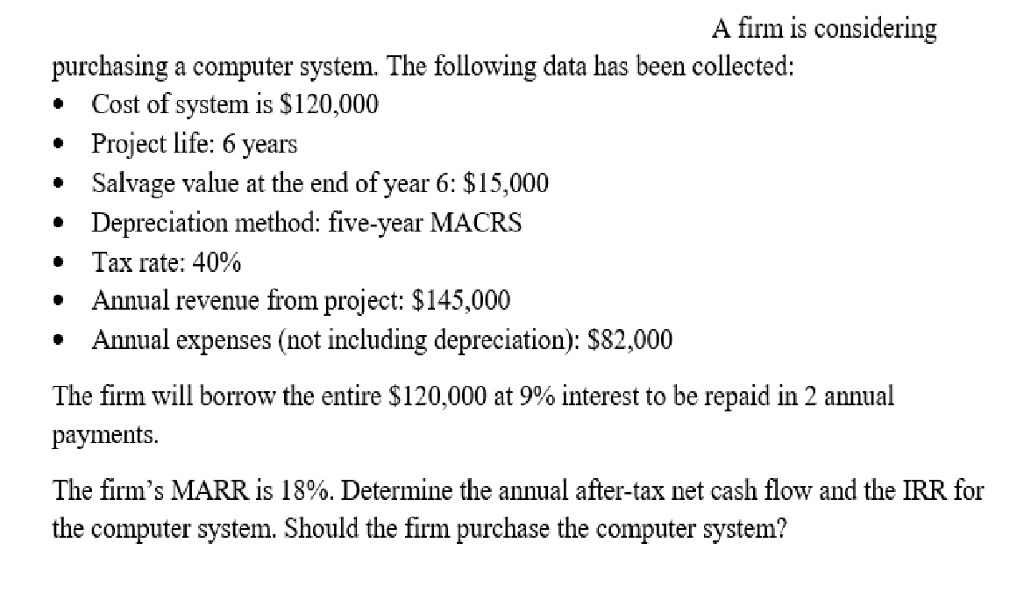

A firm is considering purchasing a computer system. The following data has been collected: Cost of system is $120,000 Project life: 6 years Salvage value at the end of year 6: $15,000 Depreciation method: five-year MACRS Tax rate: 40% Annual revenue from project: $145,000 Annual expenses (not including depreciation): $82,000 The firm will borrow the entire $120,000 at 9% interest to be repaid in 2 annual payments. The firm's MARR is 18%. Determine the annual after-tax net cash flow and the IRR for the computer system. Should the firm purchase the computer system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts