Question: If market value method is used to value non - current assets, all assets must be listed at a . Their appraised values as revealed

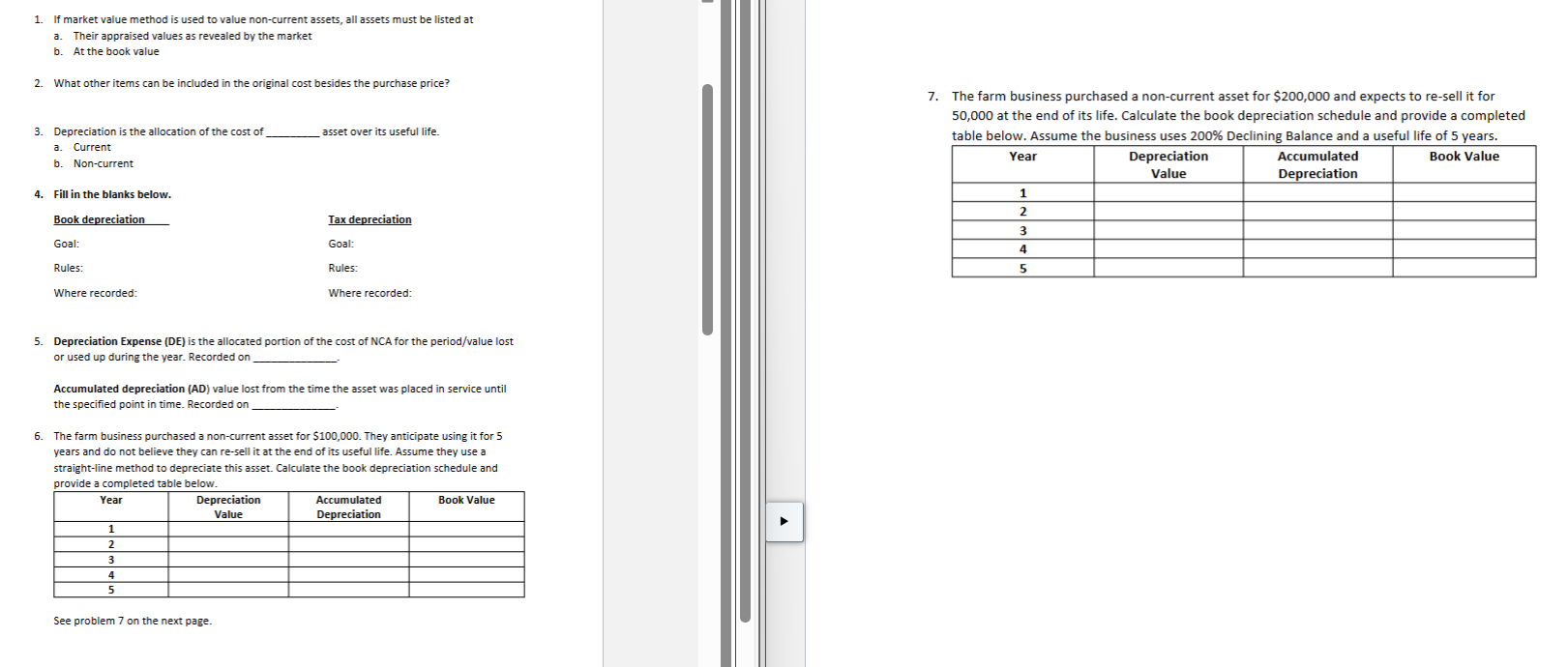

If market value method is used to value noncurrent assets, all assets must be listed at

a Their appraised values as revealed by the market

b At the book value

What other items can be included in the original cost besides the purchase price?

Depreciation is the allocation of the cost of

asset over its useful life.

a Current

b Noncurrent

Fill in the blanks below.

Book depreciation

Tax depreciation

Goal:

Goal:

Rules:

Rules:

Where recorded:

Where recorded:

Depreciation Expense DE is the allocated portion of the cost of NCA for the periodvalue lost

or used up during the year. Recorded on

Accumulated depreciation AD value lost from the time the asset was placed in service until

the specified point in time. Recorded on

The farm business purchased a noncurrent asset for $ They anticipate using it for

years and do not believe they can resell it at the end of its useful life. Assume they use a

straightline method to depreciate this asset. Calculate the book depreciation schedule and

provide a completed table below.

See problem on the next page.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock