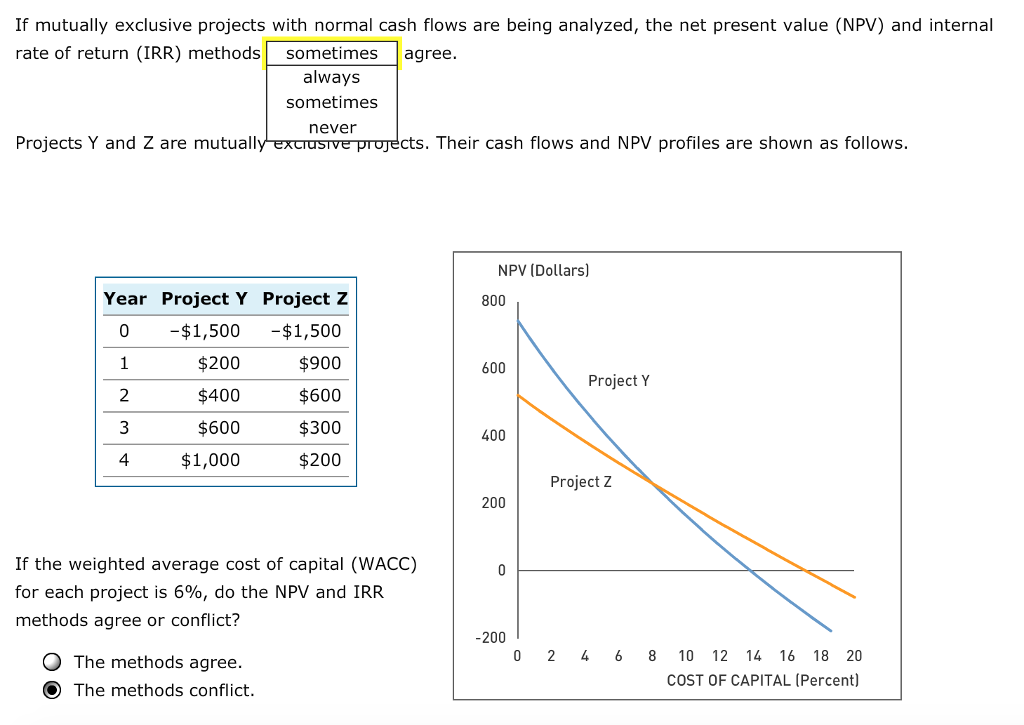

Question: If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods sometimes agree

If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods sometimes agree always sometimes never Projects Y and Z are mutually excusmve cts. Their cash flows and NPV profiles are shown as follows NPV (Dollars) Year Project Y Project Z 800 $1,500 $1,500 $200 $900 600 Project Y $400 $600 $600 $300 400 4 $1,000 $200 Project Z 200 If the weighted average cost of capital (WACC) for each project is 6%, do the NPV and IRR methods agree or conflict? 200 2 4 6 8 10 12 14 16 18 20 O The methods agree. COST OF CAPITAL (Percent) The methods conflict

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts