Question: IF POSSIBLE, PLEASE ANSWER THE TWO QUESTIONS IN THE YELLOW BOXES WITH EXCEL FORMULAS. THANK YOU. 397 We have added the Total Free Cash Flow

IF POSSIBLE, PLEASE ANSWER THE TWO QUESTIONS IN THE YELLOW BOXES WITH EXCEL FORMULAS. THANK YOU.

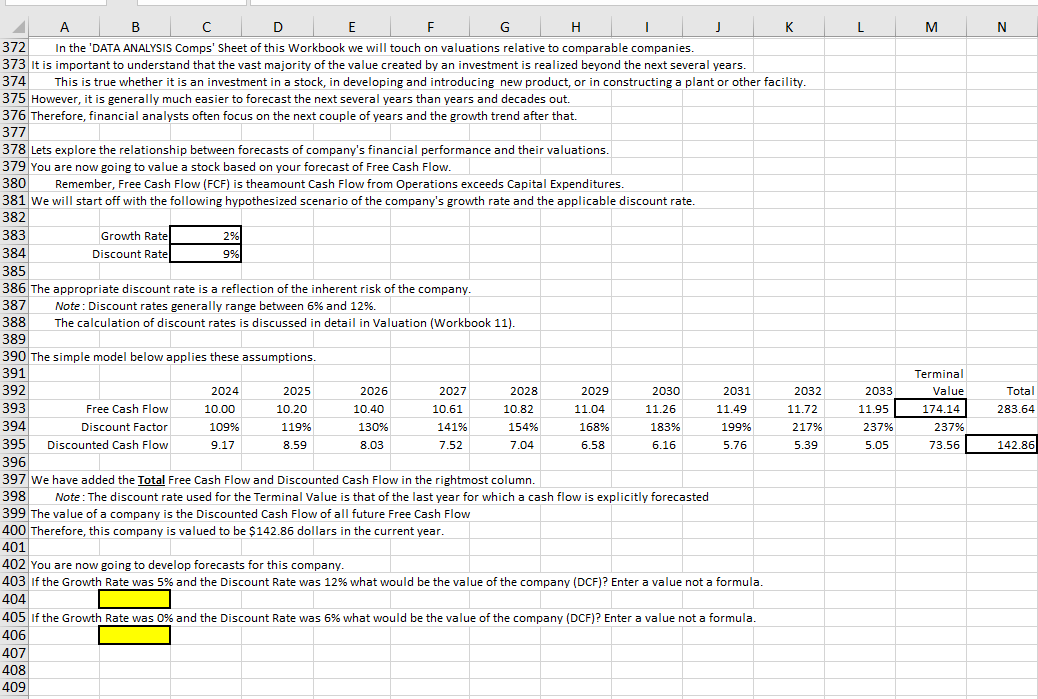

397 We have added the Total Free Cash Flow and Discounted Cash Flow in the rightmost column. 398 Note: The discount rate used for the Terminal Value is that of the last year for which a cash flow is explicitly forecasted 399 The value of a company is the Discounted Cash Flow of all future Free Cash Flow 400 Therefore, this company is valued to be $142.86 dollars in the current year. 401 402 You are now going to develop forecasts for this company. 403 If the Growth Rate was 5% and the Discount Rate was 12% what would be the value of the company (DCF)? Enter a value not a formula. 404 405 If the Growth Rate was 0% and the Discount Rate was 6% what would be the value of the company (DCF)? Enter a value not a formula. 397 We have added the Total Free Cash Flow and Discounted Cash Flow in the rightmost column. 398 Note: The discount rate used for the Terminal Value is that of the last year for which a cash flow is explicitly forecasted 399 The value of a company is the Discounted Cash Flow of all future Free Cash Flow 400 Therefore, this company is valued to be $142.86 dollars in the current year. 401 402 You are now going to develop forecasts for this company. 403 If the Growth Rate was 5% and the Discount Rate was 12% what would be the value of the company (DCF)? Enter a value not a formula. 404 405 If the Growth Rate was 0% and the Discount Rate was 6% what would be the value of the company (DCF)? Enter a value not a formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts