Question: if possible, please do on excel and explain step by step how you got to the solutions, thank you! Assume that you were the financial

if possible, please do on excel and explain step by step how you got to the solutions, thank you!

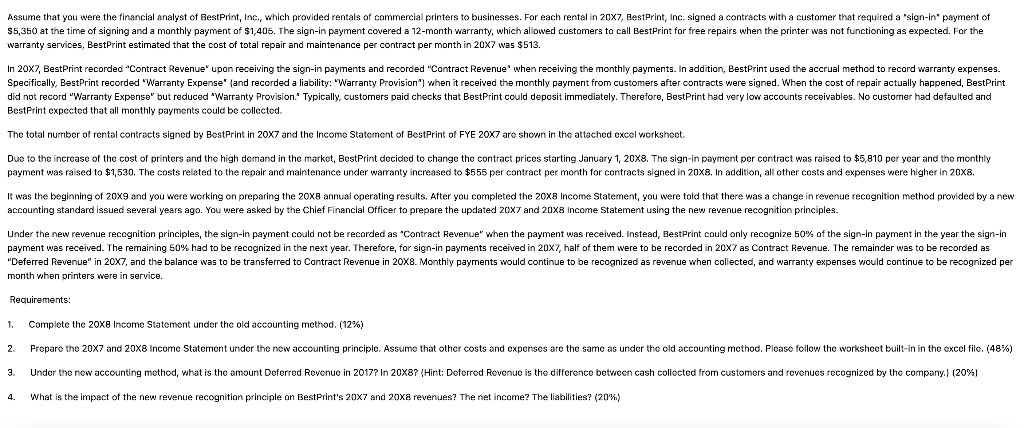

Assume that you were the financial analyst of BestPrint, Inc., which provided rentals of commercial printers to businesses. For each rental in 20x7, BestPrint, Inc. signed a contracts with a customer that required a "sign-in" payment of $5,350 at the time of signing and a monthly payment of $1,405. The sign-in payment covered a 12-month warranty, which allowed customers to call BestPrint for free repairs when the printer was not functioning as expected. For the warranty services, BestPrint estimated that the cost of total repair and maintenance per contract per month in 20X7 was $513. In 20x7, BestPrint recorded "Contract Revenue" upon receiving the sign-in payments and recorded "Contract Revenue when receiving the monthly payments. In addition, BestPrint used the accrual method to record warranty expenses. Specifically, BestPrint recorded "Warranty Expense" (and recorded a liability: 'Warranty Provision") when it received the monthly payment from customers after contracts were signed. When the cost of repair actually happened, BestPrint did not record "Warranty Expense" but reduced "Warranty Provision.' Typically, customers paid checks that BestPrint could deposit immediately. Therefore, BestPrint had very low accounts receivables. No customer had defaulted and BestPrint expected that all monthly payments could be collected. The total number of rental contracts signed by BestPrint in 20x7 and the Income Statement BestPrint of FYE 20X7 are shown in the attached excel worksheet. Due to the increase of the cost of printers and the high demand in the market, BestPrint decided to change the contract prices starting January 1, 20X8. The sign-in payment per contract was raised to $5,810 per year and the monthly payment was raised to $1,530. The costs related to the repair and maintenance under warranty increased to $555 per contract per month for contracts signed in 20x8. In addition, all other costs and expenses were higher in 20x8. It was the beginning of 20x9 and you were working on preparing the 20x8 annual operating results. After you completed the 20x8 Income Statement, you were told that there was a change in revenue recognition method provided by a new accounting standard issued several years ago. You were asked by the Chief Financial Officer to prepare the updated 20x7 and 20x8 Income Statement using the new revenue recognition principles. Under the new revenue recognition principles, the sign-in payment could not be recorded as "Contract Revenue" when the payment was received. Instead, BestPrint could only recognize 50% of the sign-in payment in the year the sign-in payment was received. The remaining 50% had to be recognized in the next year. Therefore, for sign-in payments received in 20x7, half of them were to be recorded in 20x7 as Contract Revenue. The remainder was to be recorded as "Deferred Revenue" in 20X7, and the balance was to be transferred to Contract Revenue in 20X8. Monthly payments would continue to be recognized revenue when collected, and warranty expenses would continue to be recognized per month when printers were in service. Requirements: 1. Complete the 2oxe Income Statement under the old accounting method. (12%) 2 Prepare the 20x7 and 20X8 Income Statement under the new accounting principle. Assume that other costs and expenses are the same under the old accounting method. Please follow the worksheet built-in in the excel file. (48%) 3 Under the new accounting method, what is the amount Deferred Revenue in 2017? In 20x87 (Hint: Deferred Revenue is the difference between cash collected from customers and revenues recognized by the company.) (20%) 4 What is the impact of the new revenue recognition principle on BestPrint's 20x7 and 20x8 revenues? The net income? The liabilities? (20%) Assume that you were the financial analyst of BestPrint, Inc., which provided rentals of commercial printers to businesses. For each rental in 20x7, BestPrint, Inc. signed a contracts with a customer that required a "sign-in" payment of $5,350 at the time of signing and a monthly payment of $1,405. The sign-in payment covered a 12-month warranty, which allowed customers to call BestPrint for free repairs when the printer was not functioning as expected. For the warranty services, BestPrint estimated that the cost of total repair and maintenance per contract per month in 20X7 was $513. In 20x7, BestPrint recorded "Contract Revenue" upon receiving the sign-in payments and recorded "Contract Revenue when receiving the monthly payments. In addition, BestPrint used the accrual method to record warranty expenses. Specifically, BestPrint recorded "Warranty Expense" (and recorded a liability: 'Warranty Provision") when it received the monthly payment from customers after contracts were signed. When the cost of repair actually happened, BestPrint did not record "Warranty Expense" but reduced "Warranty Provision.' Typically, customers paid checks that BestPrint could deposit immediately. Therefore, BestPrint had very low accounts receivables. No customer had defaulted and BestPrint expected that all monthly payments could be collected. The total number of rental contracts signed by BestPrint in 20x7 and the Income Statement BestPrint of FYE 20X7 are shown in the attached excel worksheet. Due to the increase of the cost of printers and the high demand in the market, BestPrint decided to change the contract prices starting January 1, 20X8. The sign-in payment per contract was raised to $5,810 per year and the monthly payment was raised to $1,530. The costs related to the repair and maintenance under warranty increased to $555 per contract per month for contracts signed in 20x8. In addition, all other costs and expenses were higher in 20x8. It was the beginning of 20x9 and you were working on preparing the 20x8 annual operating results. After you completed the 20x8 Income Statement, you were told that there was a change in revenue recognition method provided by a new accounting standard issued several years ago. You were asked by the Chief Financial Officer to prepare the updated 20x7 and 20x8 Income Statement using the new revenue recognition principles. Under the new revenue recognition principles, the sign-in payment could not be recorded as "Contract Revenue" when the payment was received. Instead, BestPrint could only recognize 50% of the sign-in payment in the year the sign-in payment was received. The remaining 50% had to be recognized in the next year. Therefore, for sign-in payments received in 20x7, half of them were to be recorded in 20x7 as Contract Revenue. The remainder was to be recorded as "Deferred Revenue" in 20X7, and the balance was to be transferred to Contract Revenue in 20X8. Monthly payments would continue to be recognized revenue when collected, and warranty expenses would continue to be recognized per month when printers were in service. Requirements: 1. Complete the 2oxe Income Statement under the old accounting method. (12%) 2 Prepare the 20x7 and 20X8 Income Statement under the new accounting principle. Assume that other costs and expenses are the same under the old accounting method. Please follow the worksheet built-in in the excel file. (48%) 3 Under the new accounting method, what is the amount Deferred Revenue in 2017? In 20x87 (Hint: Deferred Revenue is the difference between cash collected from customers and revenues recognized by the company.) (20%) 4 What is the impact of the new revenue recognition principle on BestPrint's 20x7 and 20x8 revenues? The net income? The liabilities? (20%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts