Question: If possible please explain the process thanks Required information [The following information applies to the questions displayed below.] Clopack Company manufactures one product that goes

![applies to the questions displayed below.] Clopack Company manufactures one product that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718aefb837f9_9076718aefb054ce.jpg)

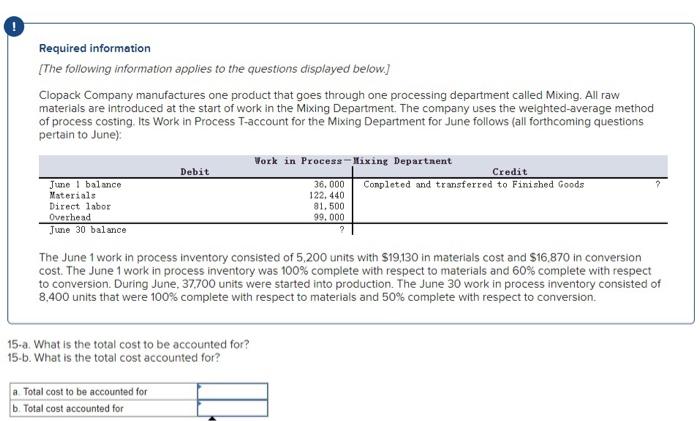

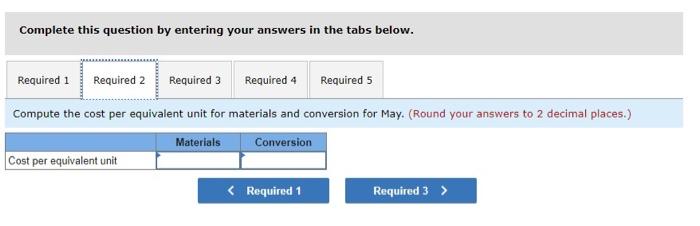

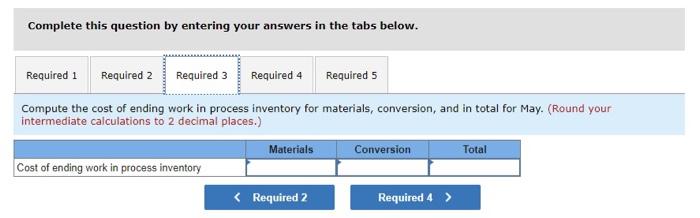

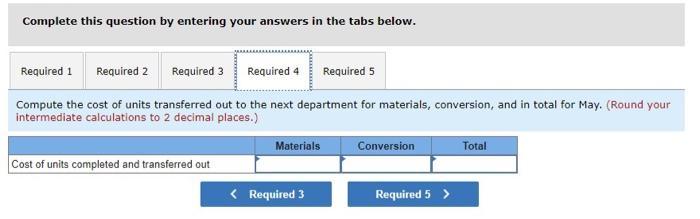

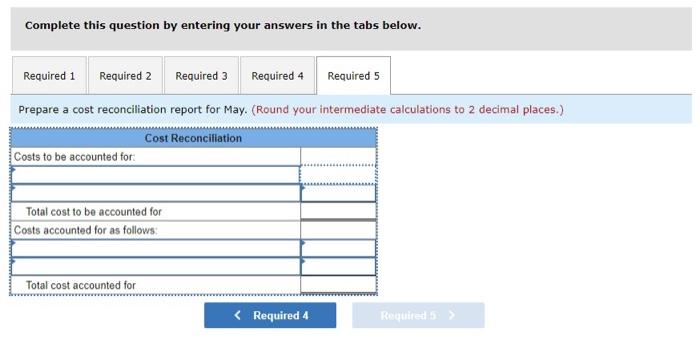

Required information [The following information applies to the questions displayed below.] Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): Work in Process Mixing Department Debit Credit June 1 balance 36.000 Completed and transferred to Finished Goods Materials Direct labor Overhead 99.000 June 30 balance 122.440 81.500 2 The June 1 work in process inventory consisted of 5,200 units with $19,130 in materials cost and $16.870 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June 37.700 units were started into production. The June 30 work in process inventory consisted of 8.400 units that were 100% complete with respect to materials and 50% complete with respect to conversion 15-a. What is the total cost to be accounted for? 15-b. What is the total cost accounted for? a Total cost to be accounted for b Total cost accounted for 2 Builder Products, Incorporated, uses the weighted average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for May Production data Pounds in process. May 1: naterials 100% complete: conversion 90% complete 71,000 Pounds started into production during May 360,000 Pounds completed and transferred out Pounds in process, May 31: materials 75% complete conversion 25% complete 31,000 Cost data: Vork in process inventory, May 1: Materials cost $ 90, 100 Conversion cost $ 48, 400 Cost added during May Materials cost $ 468.590 Conversion cost $ 265, 335 Required: 1. Compute the equivalent units of production for materials and conversion for May 2. Compute the cost per equivalent unit for materials and conversion for May. 3. Compute the cost of ending work in process inventory for materials, conversion, and in total for May 4. Compute the cost of units transferred out to the next department for materials, conversion, and in total for May 5. Prepare a cost reconciliation report for May Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the equivalent units of production for materials and conversion for May. Materials Conversion Equivalent units of production Recent Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the cost per equivalent unit for materials and conversion for May. (Round your answers to 2 decimal places.) Materials Conversion Cost per equivalent unit Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the cost of ending work in process inventory for materials, conversion, and in total for May. (Round your Intermediate calculations to 2 decimal places.) Materials Conversion Total Cost of ending work in process inventory Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the cost of units transferred out to the next department for materials, conversion, and in total for May. (Round your intermediate calculations to 2 decimal places.) Materials Conversion Total Cost of units completed and transferred out Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a cost reconciliation report for May. (Round your intermediate calculations to 2 decimal places.) Cost Reconciliation Costs to be accounted for Total cost to be accounted for Costs accounted for as follows: Total cost accounted for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts