Question: if possible please include excel functions or steps Thank you!! 4-8. If Fayetteville Capy Center joins a national franchise, annual year-end cash flow is expected

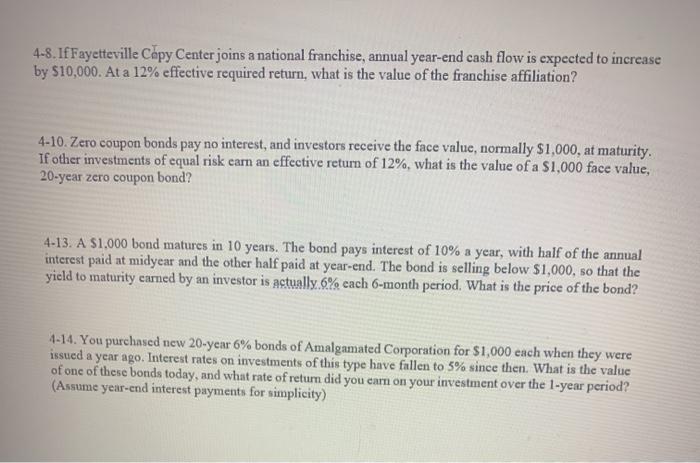

4-8. If Fayetteville Capy Center joins a national franchise, annual year-end cash flow is expected to increase by $10,000. At a 12% effective required return, what is the value of the franchise affiliation? 4-10. Zero coupon bonds pay no interest, and investors receive the face value, normally $1,000, at maturity. If other investments of equal risk earn an effective return of 12%, what is the value of a $1,000 face value, 20-year zero coupon bond? 4-13. A $1,000 bond matures in 10 years. The bond pays interest of 10% a year, with half of the annual interest paid at midyear and the other half paid at year-end. The bond is selling below $1,000, so that the yield to maturity carned by an investor is actually 6% cach 6-month period. What is the price of the bond? 4-14. You purchased new 20-year 6% bonds of Amalgamated Corporation for $1,000 each when they were issued a year ago. Interest rates on investments of this type have fallen to 5% since then. What is the value of one of these bonds today, and what rate of return did you earn on your investment over the 1-year period? (Assume year-end interest payments for simplicity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts