Question: if possible please show how it was solved on a excel worksheet 1. Suppose that Thomas Lee Corp. expects to have profits of $100000 if

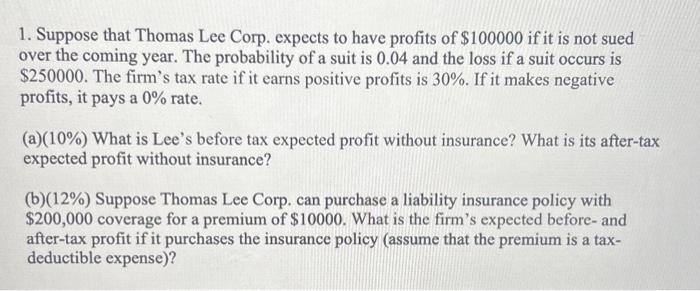

1. Suppose that Thomas Lee Corp. expects to have profits of $100000 if it is not sued over the coming year. The probability of a suit is 0.04 and the loss if a suit occurs is $250000. The firm's tax rate if it earns positive profits is 30%. If it makes negative profits, it pays a 0% rate. (a) (10%) What is Lee's before tax expected profit without insurance? What is its after-tax expected profit without insurance? (b) (12%) Suppose Thomas Lee Corp. can purchase a liability insurance policy with $200,000 coverage for a premium of $10000. What is the firm's expected before- and after-tax profit if it purchases the insurance policy (assume that the premium is a taxdeductible expense)? 1. Suppose that Thomas Lee Corp. expects to have profits of $100000 if it is not sued over the coming year. The probability of a suit is 0.04 and the loss if a suit occurs is $250000. The firm's tax rate if it earns positive profits is 30%. If it makes negative profits, it pays a 0% rate. (a) (10%) What is Lee's before tax expected profit without insurance? What is its after-tax expected profit without insurance? (b) (12%) Suppose Thomas Lee Corp. can purchase a liability insurance policy with $200,000 coverage for a premium of $10000. What is the firm's expected before- and after-tax profit if it purchases the insurance policy (assume that the premium is a taxdeductible expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts