Question: If possible to solve this with the exact equations needed and the steps. Thank you very much . A $100,000 bond, redeemable at C, pays

If possible to solve this with the exact equations needed and the steps. Thank you very much

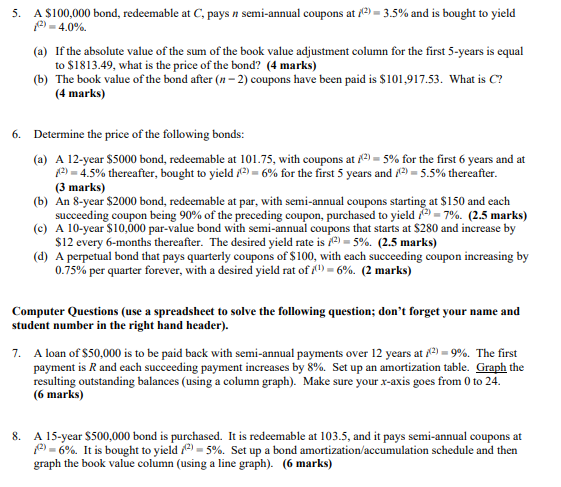

. A $100,000 bond, redeemable at C, pays a semi-annual coupons at = 3.5% and is bought to yield / 4.0% (a) If the absolute value of the sum of the book value adjustment column for the first 5-years is equal to $1813.49, what is the price of the bond? (4 marks) (b) The book value of the bond after (n - 2) coupons have been paid is $101,917.53. What is C? (4 marks) 6. Determine the price of the following bonds: (a) A 12-year $5000 bond, redeemable at 101.75, with coupons at /2- 5% for the first 6 years and at (3) = 4.5% thereafter, bought to yield /2)= 6% for the first 5 years and /2 = 5.5% thereafter. (3 marks) (b) An 8-year $2000 bond, redeemable at par, with semi-annual coupons starting at $150 and each succeeding coupon being 90% of the preceding coupon, purchased to yield ?" - 7%. (2.5 marks) (c) A 10-year $10,000 par-value bond with semi-annual coupons that starts at $280 and increase by $12 every 6-months thereafter. The desired yield rate is (?) = 5%. (2.5 marks) (d) A perpetual bond that pays quarterly coupons of $100, with each succeeding coupon increasing by 0.75% per quarter forever, with a desired yield rat of ((1) = 6%. (2 marks) Computer Questions (use a spreadsheet to solve the following question: don't forget your name and student number in the right hand header). 7. A loan of $50,000 is to be paid back with semi-annual payments over 12 years at ?) = 9%. The first payment is R and each succeeding payment increases by 8%. Set up an amortization table. Graph the resulting outstanding balances (using a column graph). Make sure your x-axis goes from ( to 24. (6 marks) 8. A 15-year $500,000 bond is purchased. It is redeemable at 103.5, and it pays semi-annual coupons at /4- 6% It is bought to yield ?"= 5%. Set up a bond amortization/accumulation schedule and then graph the book value column (using a line graph). (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts