Question: If possible, use Excel and cell references, please. 105 ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that

If possible, use Excel and cell references, please.

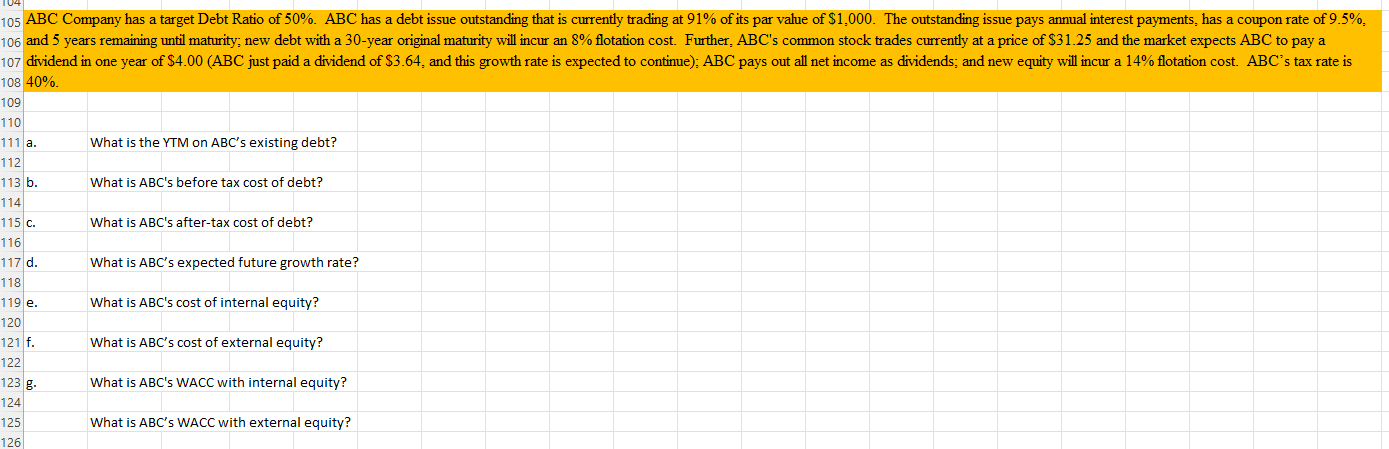

105 ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that is currently trading at 91% of its par value of $1,000. The outstanding issue pays annual interest payments, has a coupon rate of 9.5%, 106 and 5 years remaining until maturity; new debt with a 30-year original maturity will incur an 8% flotation cost. Further, ABC's common stock trades currently at a price of $31.25 and the market expects ABC to pay a 107 dividend in one year of $4.00 (ABC just paid a dividend of $3.64, and this growth rate is expected to continue); ABC pays out all net income as dividends; and new equity will incur a 14% flotation cost. ABC's tax rate is 108 40%. 109 110 111 a. What is the YTM on ABC's existing debt? 112 113 b. What is ABC's before tax cost of debt? 114 115 c. What is ABC's after-tax cost of debt? 116 117 d. What is ABC's expected future growth rate? 118 119 e. What is ABC's cost of internal equity? 120 121 f. What is ABC's cost of external equity? 122 123 g. What is ABC's WACC with internal equity? 124 125 What is ABC's WACC with external equity? 126 105 ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that is currently trading at 91% of its par value of $1,000. The outstanding issue pays annual interest payments, has a coupon rate of 9.5%, 106 and 5 years remaining until maturity; new debt with a 30-year original maturity will incur an 8% flotation cost. Further, ABC's common stock trades currently at a price of $31.25 and the market expects ABC to pay a 107 dividend in one year of $4.00 (ABC just paid a dividend of $3.64, and this growth rate is expected to continue); ABC pays out all net income as dividends; and new equity will incur a 14% flotation cost. ABC's tax rate is 108 40%. 109 110 111 a. What is the YTM on ABC's existing debt? 112 113 b. What is ABC's before tax cost of debt? 114 115 c. What is ABC's after-tax cost of debt? 116 117 d. What is ABC's expected future growth rate? 118 119 e. What is ABC's cost of internal equity? 120 121 f. What is ABC's cost of external equity? 122 123 g. What is ABC's WACC with internal equity? 124 125 What is ABC's WACC with external equity? 126

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts