Question: need to know how to solve for b 9. ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that

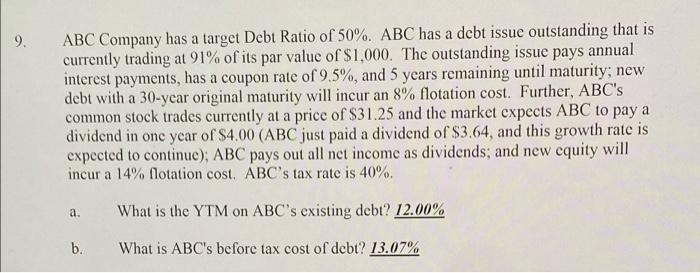

9. ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that is currently trading at 91% of its par value of $1,000. The outstanding issue pays annual interest payments, has a coupon rate of 9.5%, and 5 years remaining until maturity, new debt with a 30-year original maturity will incur an 8% flotation cost. Further, ABC's common stock trades currently at a price of $31.25 and the market expects ABC to pay a dividend in one year of $4.00 (ABC just paid a dividend of $3.64, and this growth rate is expected to continue); ABC pays out all net income as dividends; and new cquity will incur a 14% Notation cost. ABC's tax rate is 40% a. What is the YTM on ABC's existing debt? 12.00% b. What is ABC's before tax cost of debt? 13.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts