Question: If someone can help me solve this, I will give a thumbs up. Thank You! I just need help for studying for this test. Suppose

If someone can help me solve this, I will give a thumbs up. Thank You! I just need help for studying for this test.

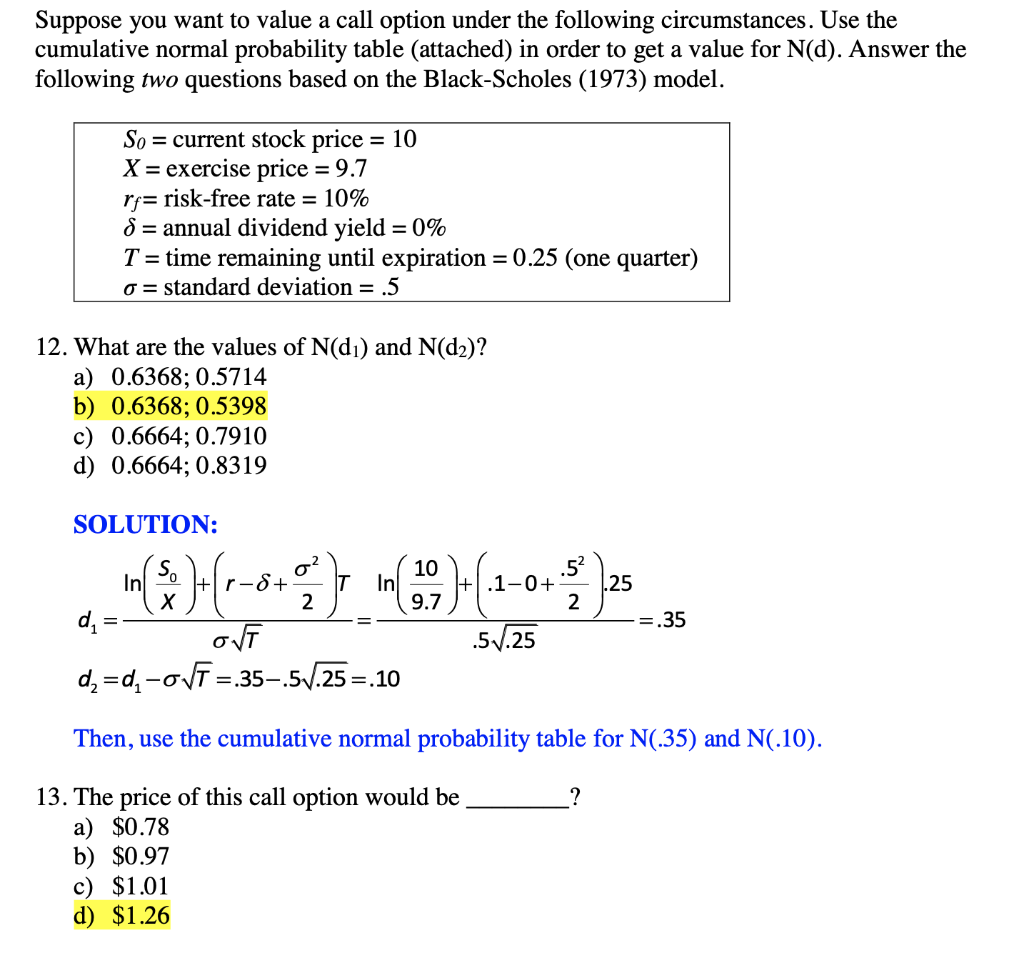

Suppose you want to value a call option under the following circumstances. Use the cumulative normal probability table (attached) in order to get a value for N(d). Answer the following two questions based on the Black-Scholes (1973) model. = So = current stock price = 10 X = exercise price = 9.7 rf= risk-free rate = 10% S = annual dividend yield = 0% T = time remaining until expiration = 0.25 (one quarter) o= standard deviation = .5 = = 12. What are the values of N(d) and N(d)? a) 0.6368; 0.5714 b) 0.6368; 0.5398 c) 0.6664; 0.7910 d) 0.6664; 0.8319 SOLUTION: 10 .52 In 2-) H- 1 (*)-(1-0 In .25 2 9.7 2 =.35 +r-8+ X do = OVT de=d, -ONT=.35.57.25 = 10 .57.25 = Then, use the cumulative normal probability table for N(.35) and N0.10). ? 13. The price of this call option would be a) $0.78 b) $0.97 c) $1.01 d) $1.26 Suppose you want to value a call option under the following circumstances. Use the cumulative normal probability table (attached) in order to get a value for N(d). Answer the following two questions based on the Black-Scholes (1973) model. = So = current stock price = 10 X = exercise price = 9.7 rf= risk-free rate = 10% S = annual dividend yield = 0% T = time remaining until expiration = 0.25 (one quarter) o= standard deviation = .5 = = 12. What are the values of N(d) and N(d)? a) 0.6368; 0.5714 b) 0.6368; 0.5398 c) 0.6664; 0.7910 d) 0.6664; 0.8319 SOLUTION: 10 .52 In 2-) H- 1 (*)-(1-0 In .25 2 9.7 2 =.35 +r-8+ X do = OVT de=d, -ONT=.35.57.25 = 10 .57.25 = Then, use the cumulative normal probability table for N(.35) and N0.10). ? 13. The price of this call option would be a) $0.78 b) $0.97 c) $1.01 d) $1.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts