Question: if someone knows and understands using excel formulas PLEASE HELP Natalie is 8 years old and has been gifted shares of stock in an airline.

if someone knows and understands using excel formulas PLEASE HELP

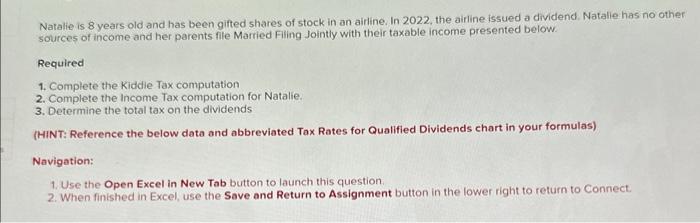

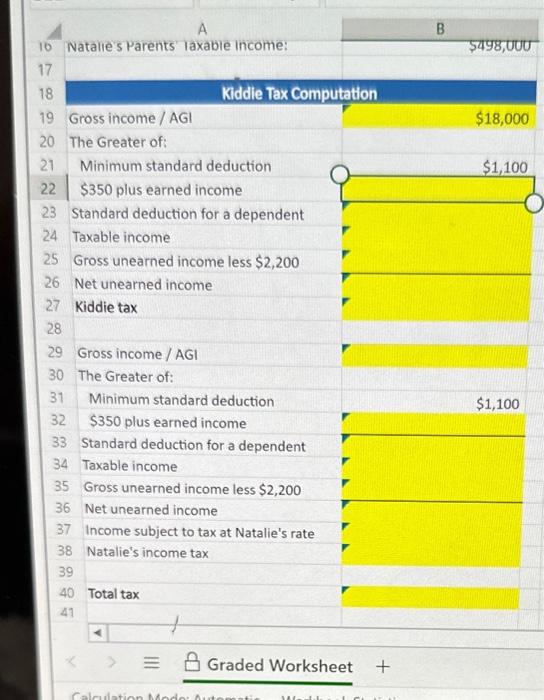

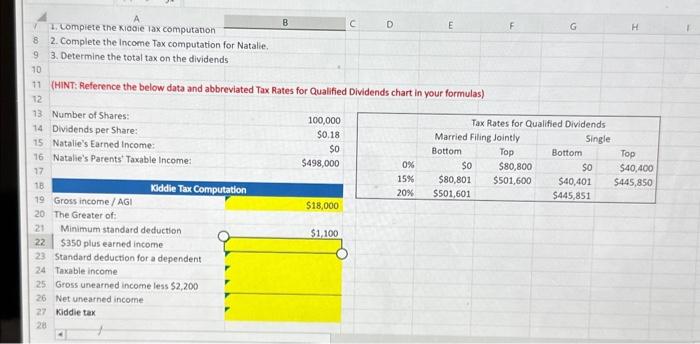

if someone knows and understands using excel formulas PLEASE HELPNatalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no other sources of income and her parents file Married Filing Jointly with their taxable income presented below: Required 1. Complete the Kiddie Tax computation 2. Complete the Income Tax computation for Natalie. 3. Determine the total tax on the dividends (HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) Navigation: 1. Use the Open Excel in New Tab button to launch this question 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. A (HINT: Aeference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no other sources of income and her parents file Married Filing Jointly with their taxable income presented below: Required 1. Complete the Kiddie Tax computation 2. Complete the Income Tax computation for Natalie. 3. Determine the total tax on the dividends (HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) Navigation: 1. Use the Open Excel in New Tab button to launch this question 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. A (HINT: Aeference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts