Question: if the answer is correct ill leave a like thankss In 2022, Amanda and Jaxon Stuart have a daughter who is 1 year old. The

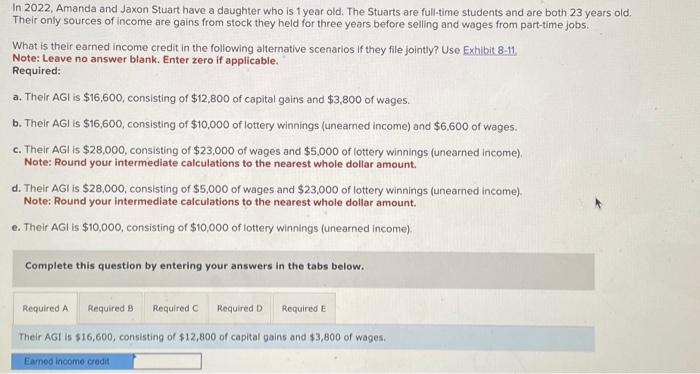

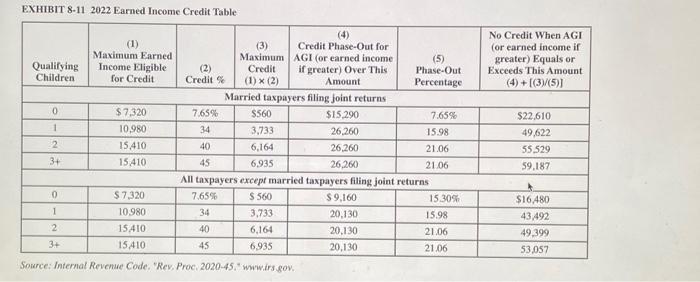

In 2022, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-11, Note: Leave no answer blank. Enter zero if applicable. Required: a. Their AGl is $16,600, consisting of $12,800 of capital gains and $3,800 of wages. b. Their AGl is $16,600, consisting of $10,000 of lottery winnings (unearned income) and $6,600 of wages. c. Their AGI is $28,000, consisting of $23,000 of wages and $5,000 of lottery winnings (unearned income). Note: Round your intermediate calculations to the nearest whole dollar amount. d. Their AGI is $28,000, consisting of $5,000 of wages and $23,000 of lottery winnings (unearned income). Note: Round your intermediate calculations to the nearest whole dollar amount. e. Their AGI is $10,000, consisting of $10,000 of lottery winnings (unearned income), Complete this question by entering your answers in the tabs below. Their AGI is $16,600, consisting of $12,800 of capital gains and $3,800 of wages. EXHIBIT 8-11 2022 Earned Income Credit Table Au taxpayers except married Source: Internal Revenue Code. "Rev. Proc. 2020-45, " wwwirs gov

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts