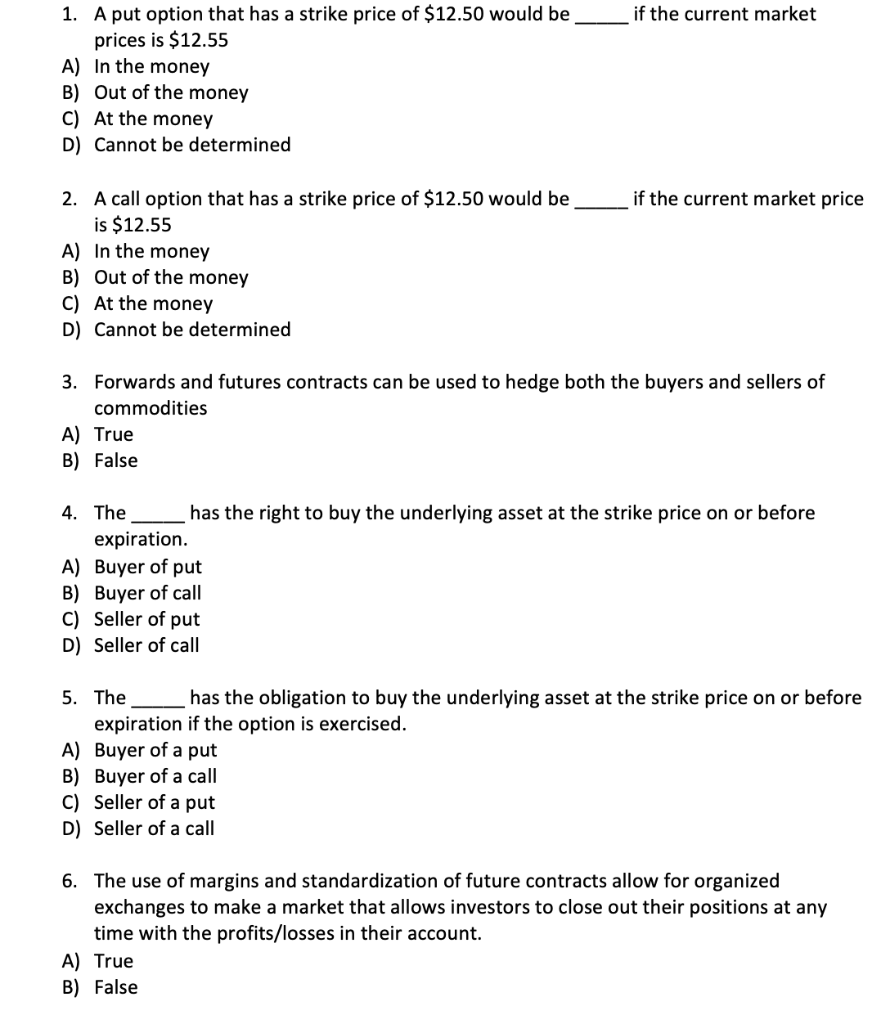

Question: if the current market 1. A put option that has a strike price of $12.50 would be prices is $12.55 A) In the money B)

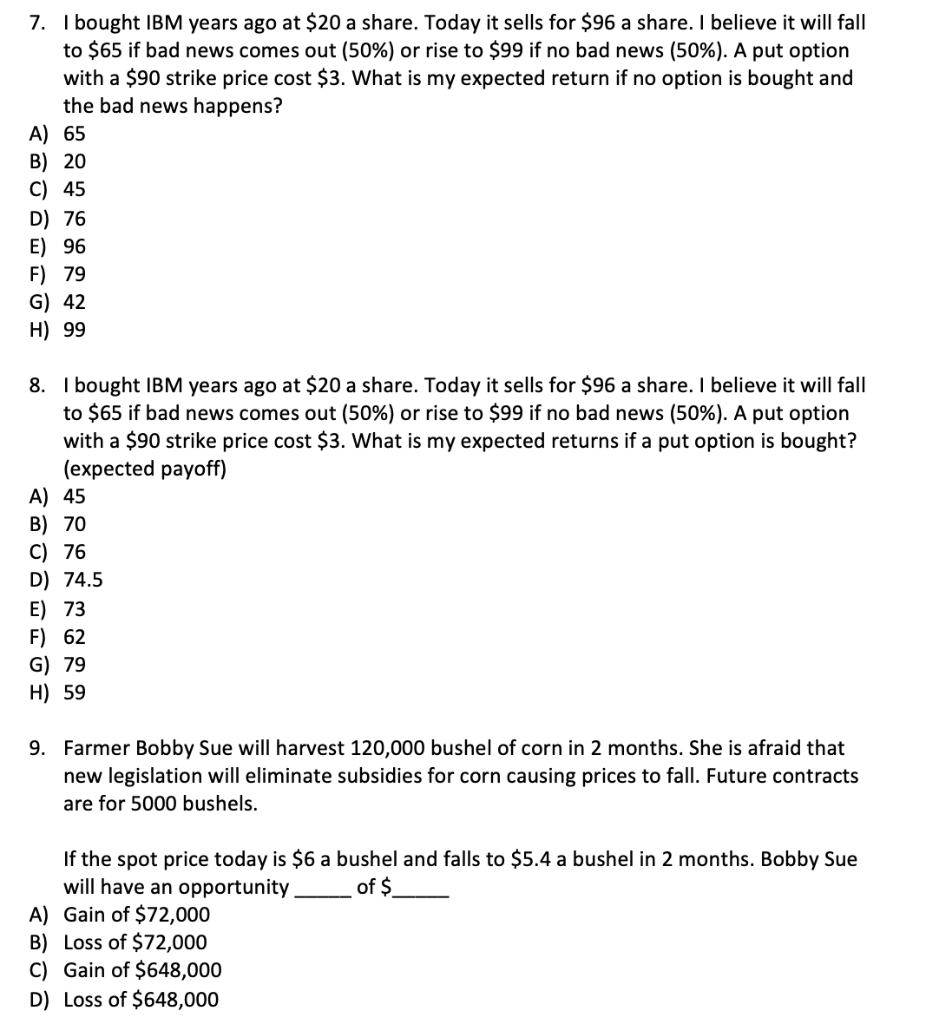

if the current market 1. A put option that has a strike price of $12.50 would be prices is $12.55 A) In the money B) Out of the money c) At the money D) Cannot be determined if the current market price 2. A call option that has a strike price of $12.50 would be is $12.55 A) In the money B) Out of the money C) At the money D) Cannot be determined 3. Forwards and futures contracts can be used to hedge both the buyers and sellers of commodities A) True B) False 4. The has the right to buy the underlying asset at the strike price on or before expiration. A) Buyer of put B) Buyer of call C) Seller of put D) Seller of call 5. The_ has the obligation to buy the underlying asset at the strike price on or before expiration if the option is exercised. A) Buyer of a put B) Buyer of a call C) Seller of a put D) Seller of a call 6. The use of margins and standardization of future contracts allow for organized exchanges to make a market that allows investors to close out their positions at any time with the profits/losses in their account. A) True B) False 7. I bought IBM years ago at $20 a share. Today it sells for $96 a share. I believe it will fall to $65 if bad news comes out (50%) or rise to $99 if no bad news (50%). A put option with a $90 strike price cost $3. What is my expected return if no option is bought and the bad news happens? A) 65 B) 20 C) 45 8. I bought IBM years ago at $20 a share. Today it sells for $96 a share. I believe it will fall to $65 if bad news comes out (50%) or rise to $99 if no bad news (50%). A put option with a $90 strike price cost $3. What is my expected returns if a put option is bought? (expected payoff) A) 45 B) 70 C) 76 D) 74.5 E) 73 F) 62 G) 79 H) 59 9. Farmer Bobby Sue will harvest 120,000 bushel of corn in 2 months. She is afraid that new legislation will eliminate subsidies for corn causing prices to fall. Future contracts are for 5000 bushels. If the spot price today is $6 a bushel and falls to $5.4 a bushel in 2 months. Bobby Sue will have an opportunity _ _ of $___ A) Gain of $72,000 B) Loss of $72,000 C) Gain of $648,000 D) Loss of $648,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts