Question: If the model below is to give a reasonable valuation of a stock, which of the following is not a valid assumption for the model?

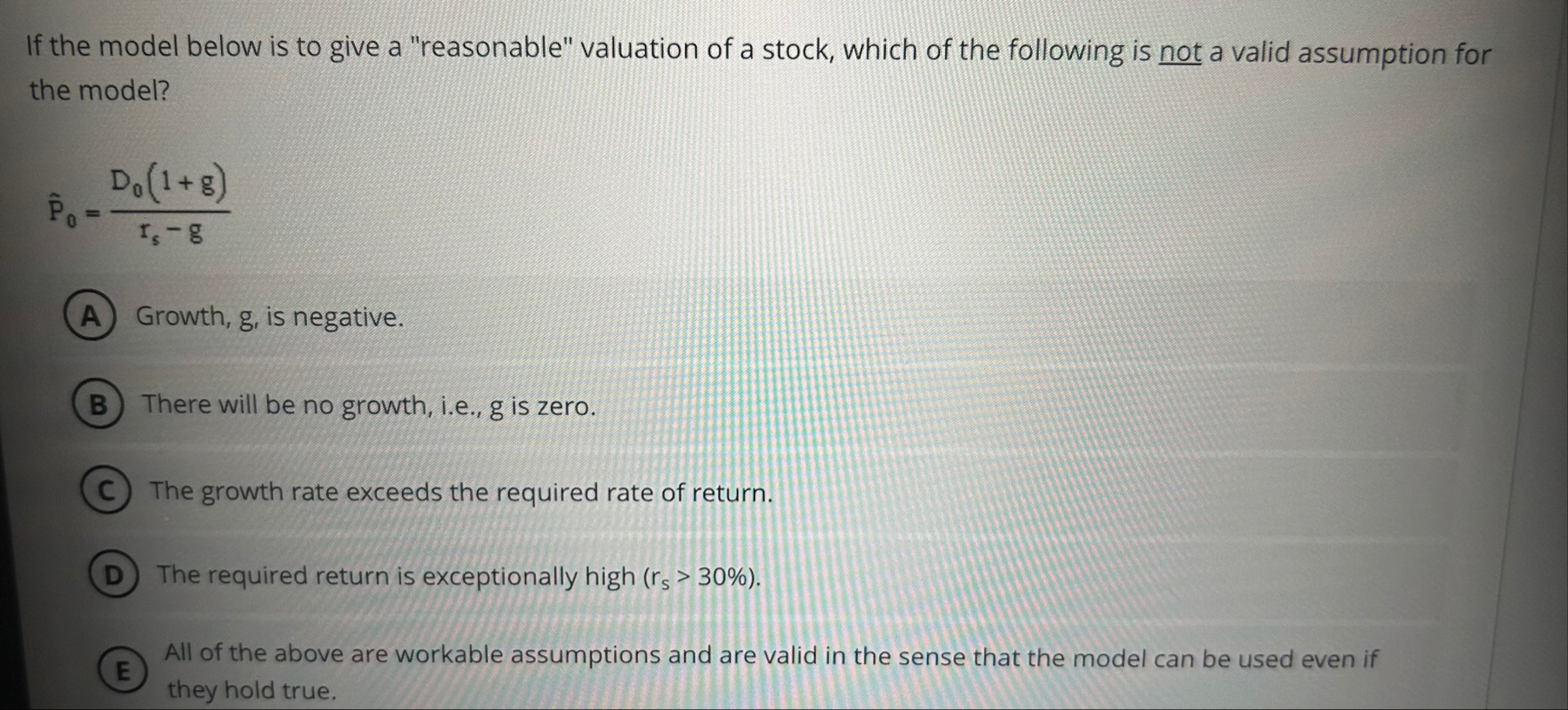

If the model below is to give a "reasonable" valuation of a stock, which of the following is not a valid assumption for the model?

hat

Growth, g is negative.

There will be no growth, ie g is zero.

The growth rate exceeds the required rate of return.

The required return is exceptionally high

All of the above are workable assumptions and are valid in the sense that the model can be used even if they hold true.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock