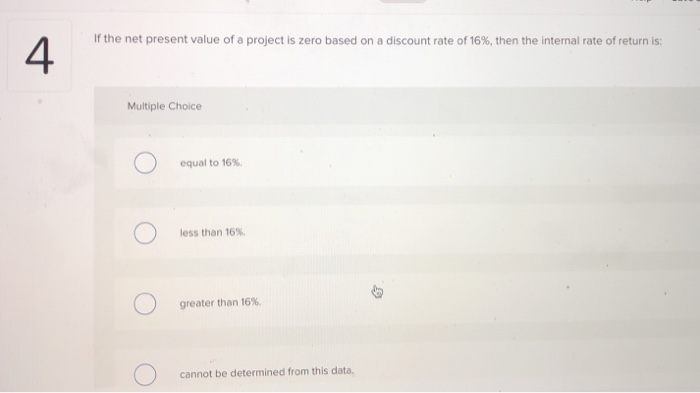

Question: If the net present value of a project is zero based on a discount rate of 16%, then the internal rate of return is: 4

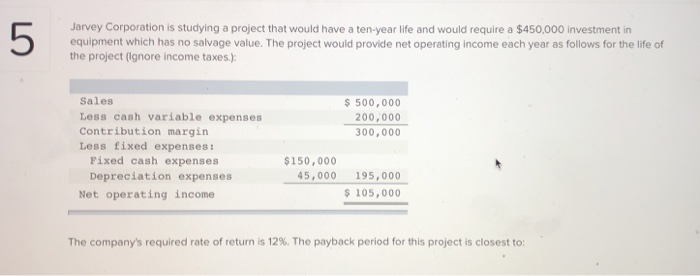

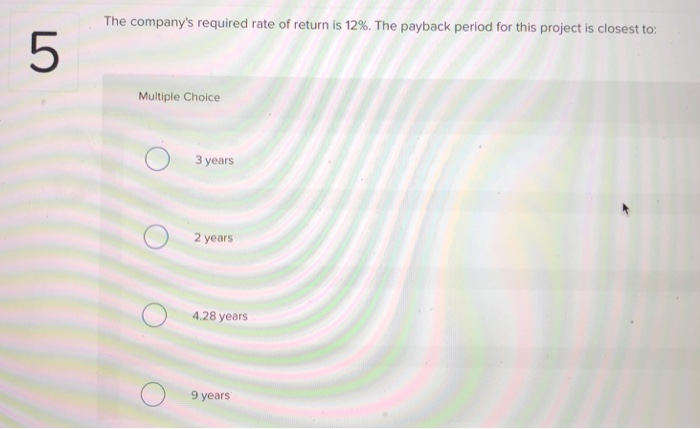

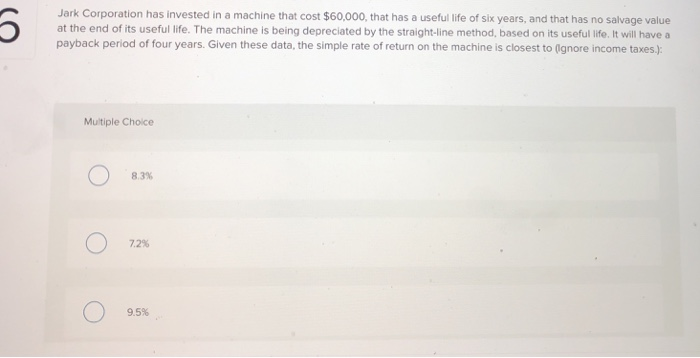

If the net present value of a project is zero based on a discount rate of 16%, then the internal rate of return is: 4 Multiple Choice O equal to 16%, 0 less than 16%. greater than 16%. cannot be determined from this data 5: Jarvey Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (ignore income taxes): Sales Less cash variable expenses Contribution margin Less fixed expenses: 500,000 200,000 300,000 Fixed cash expenses Depreciation expenses45,00 195,000 $150,000 Net operating income 105,000 . The cormpany's required rate of return is 12%. The payback period for this project is closest to: The company's required rate of return is 12%. The payback period for this project is closest to: 5 Multiple Choice 3 years 2 years 4.28 years 9 years Jark Corporation has invested in a machine that cost $60,000, that has a useful life of sik years, and that has no salvage value at the end of its useful life. The machine is being depreciated by the straight-line method, based on its useful life. It will have a payback period of four years. Given these data, the simple rate of return on the machine is closest to ignore income taxes.) Multiple Choice 83% 72% 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts