Question: If the parent company uses the equity method to record its investment in a subsidiary in its internal accounting records, which of the following statements

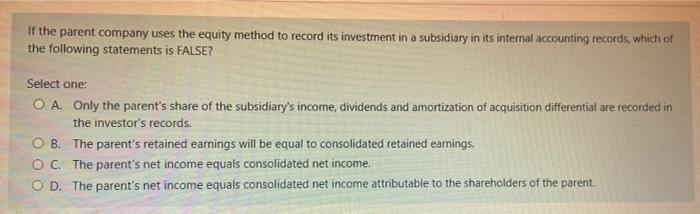

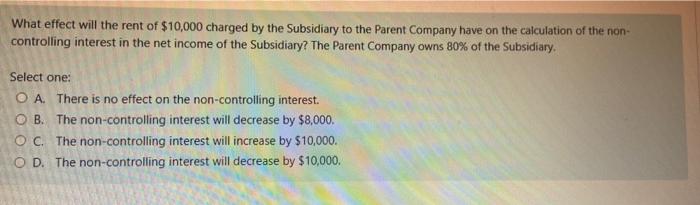

If the parent company uses the equity method to record its investment in a subsidiary in its internal accounting records, which of the following statements is FALSE? Select one: O A. Only the parent's share of the subsidiary's income, dividends and amortization of acquisition differential are recorded in the investor's records. O B. The parent's retained earnings will be equal to consolidated retained earnings. O C. The parent's net income equals consolidated net income. OD. The parent's net income equals consolidated net income attributable to the shareholders of the parent What effect will the rent of $10,000 charged by the Subsidiary to the Parent Company have on the calculation of the non- controlling interest in the net income of the Subsidiary? The Parent Company owns 80% of the Subsidiary. Select one: O A. There is no effect on the non-controlling interest. OB. The non-controlling interest will decrease by $8,000. OC. The non-controlling interest will increase by $10,000. OD. The non-controlling interest will decrease by $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts