Question: If the Put option's exercise price is $100. The current stock price is $100. When the market is good, the stock's price after 1 year

If the Put option's exercise price is $100. The current stock price is $100. When the market is good, the stock's price after 1 year is $120. When the market is bad, the stock's price is $90. The current interest rate is 10%. If the prevailing put premium is $4.00.You would like to construct an arbitrage portfolio to profit from it

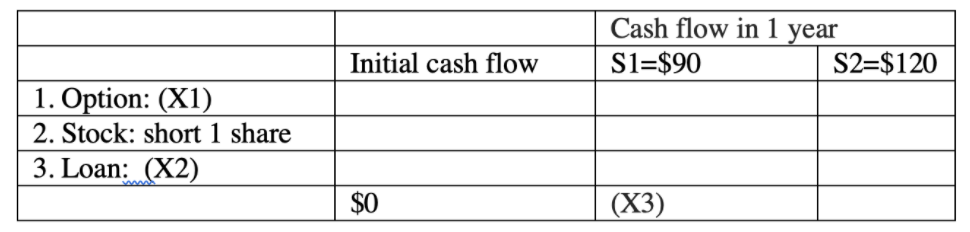

If the Put option's exercise price is $100. The current stock price is $100. When the market is good, the stock's price after 1 year is $120. When the market is bad, the stock's price is $90. The current interest rate is 10%. If the prevailing put premium is $4.00.You would like to construct an arbitrage portfolio to profit from it

What is the action in the option market (cell X1)?

What is the action in the T-bill market (cell X2)?

What is the cashflow in Cell X3?

Cash flow in 1 year Si=$90 S2=$120 Initial cash flow 1. Option: (X1) 2. Stock: short 1 share 3. Loan: (X2) $0 (X3)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock