Question: If u answer all questions correct I will give a thumbs up. 8. Money market instruments: Eurodollar securities Which of the following are typical Euronote

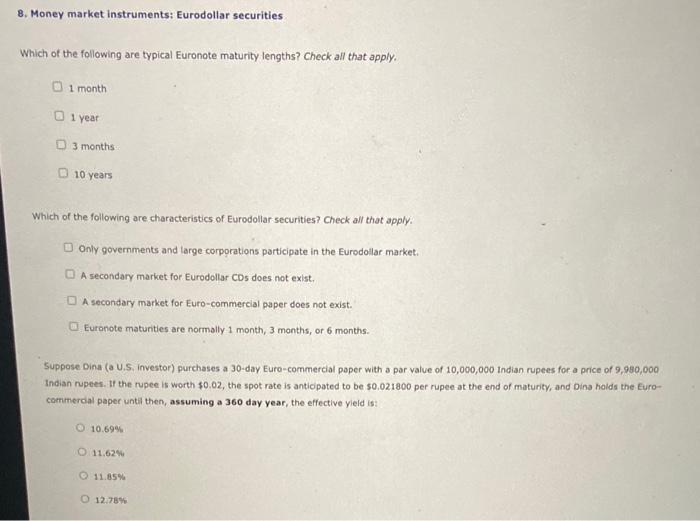

8. Money market instruments: Eurodollar securities Which of the following are typical Euronote maturity lengths? Check all that apply. 1 month 1 year 3 months 10 years Which of the following are characteristics of Eurodollar securities? Check all that apply. Only governments and large corporations participate in the Eurodollar market. A secondary market for Eurodollar CDs does not exist. A secondary market for Euro-commercial paper does not exist. Euronote maturities are normally 1 month, 3 months, or 6 months. Suppose Dina (a U.S. investor) purchases a 30-day Euro-commercial poper with a par value of 10,000,000 indian rupees for a price of 9,980,000 Indian nupees. If the rupee is worth $0.02, the spot rate is antiopated to be s0.021800 per rupee at the end of maturit, and Dina holds the Eurocommerdal paper untll then, assuming a 360 day year, the effective yieid is: 10.699 11.62% 11.85% 12.78%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts