Question: If u answer all questions correct I will give a thumbs up. Which of the following are typical repurchase agreement maturities? Check all that apply.

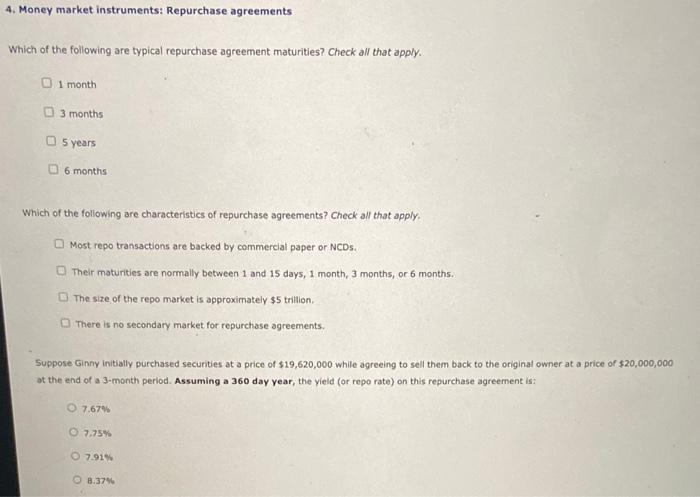

Which of the following are typical repurchase agreement maturities? Check all that apply. 1 month 3 months 5 years 6 months Which of the following are characteristics of repurchase agreements? Check all that apply. Most repo transactions are backed by commercial paper or NCDs. Their maturities are normally between 1 and 15 days, 1 month, 3 months, or 6 months. The size of the repo market is approximately $5 trilition. There is no secondary market for repurchose agreements. Suppose Ginny initially purchased securities at a price of $19,620,000 while agreeing to sell them back to the original owner at a price of $20,000,000 ot the end of a 3-month period. Assuming a 360 day year, the yield (or repo rate) on this repurchase agreement is: 7.67%7.75%7.91%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts