Question: If u need send complete solution Q.1 A company receives a bank statement. The balance on its cash book (= bank account in the main

If u need send complete solution

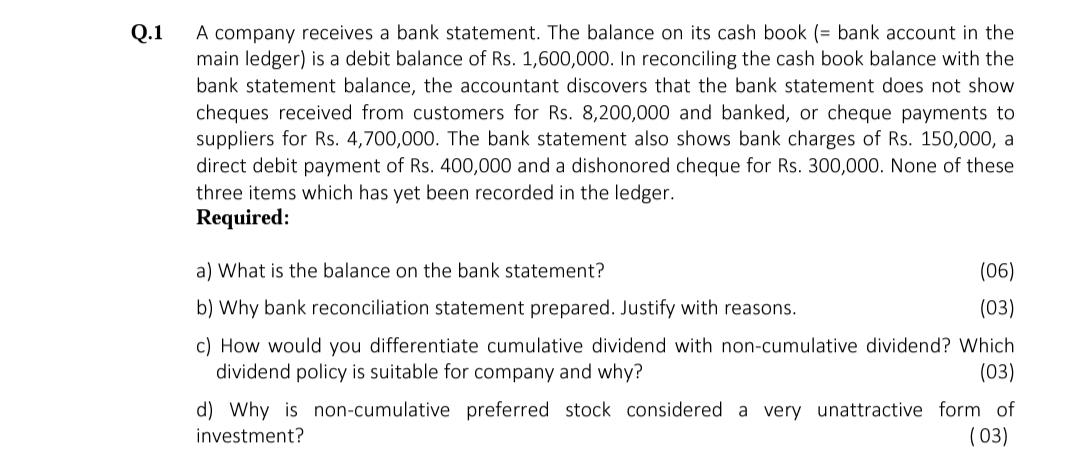

Q.1 A company receives a bank statement. The balance on its cash book (= bank account in the main ledger) is a debit balance of Rs. 1,600,000. In reconciling the cash book balance with the bank statement balance, the accountant discovers that the bank statement does not show cheques received from customers for Rs. 8,200,000 and banked, or cheque payments to suppliers for Rs. 4,700,000. The bank statement also shows bank charges of Rs. 150,000, a direct debit payment of Rs. 400,000 and a dishonored cheque for Rs. 300,000. None of these three items which has yet been recorded in the ledger. Required: a) What is the balance on the bank statement? (06) b) Why bank reconciliation statement prepared. Justify with reasons. (03) c) How would you differentiate cumulative dividend with non-cumulative dividend? Which dividend policy is suitable for company and why? (03) d) Why is non-cumulative preferred stock considered a very unattractive form of investment? (03)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts