Question: if ur answer is wrong, i will dislike it for sure Corporate Valuation 12. Following information is given in respect of WXY Ltd., which is

if ur answer is wrong, i will dislike it for sure

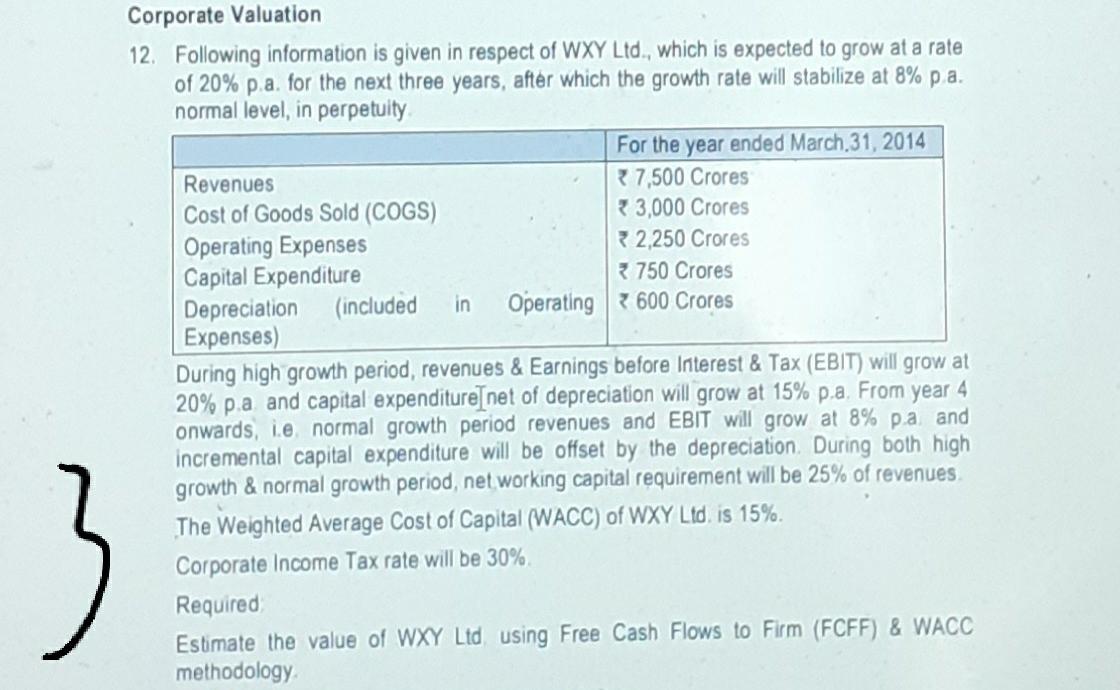

Corporate Valuation 12. Following information is given in respect of WXY Ltd., which is expected to grow at a rate of 20% p.a. for the next three years, after which the growth rate will stabilize at 8% pa. normal level, in perpetuity For the year ended March 31, 2014 Revenues 7,500 Crores Cost of Goods Sold (COGS) 3,000 Crores Operating Expenses 32,250 Crores Capital Expenditure 3 750 Crores Depreciation (included in Operating 600 Crores Expenses) During high growth period, revenues & Earnings before Interest & Tax (EBIT) will grow at 20% pa and capital expenditure net of depreciation will grow at 15% p.a. From year 4 onwards, i.e normal growth period revenues and EBIT will grow at 8% pa and incremental capital expenditure will be offset by the depreciation. During both high growth & normal growth period, net working capital requirement will be 25% of revenues The Weighted Average Cost of Capital (WACC) of WXY Ltd. is 15%. Corporate Income Tax rate will be 30%. Required Estimate the value of WXY Ltd using Free Cash Flows to Firm (FCFF) & WACC methodology

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts