Question: If you are self - employed, one way to avoid a penalty from the IRS is to: owe less than $ 1 , 0 0

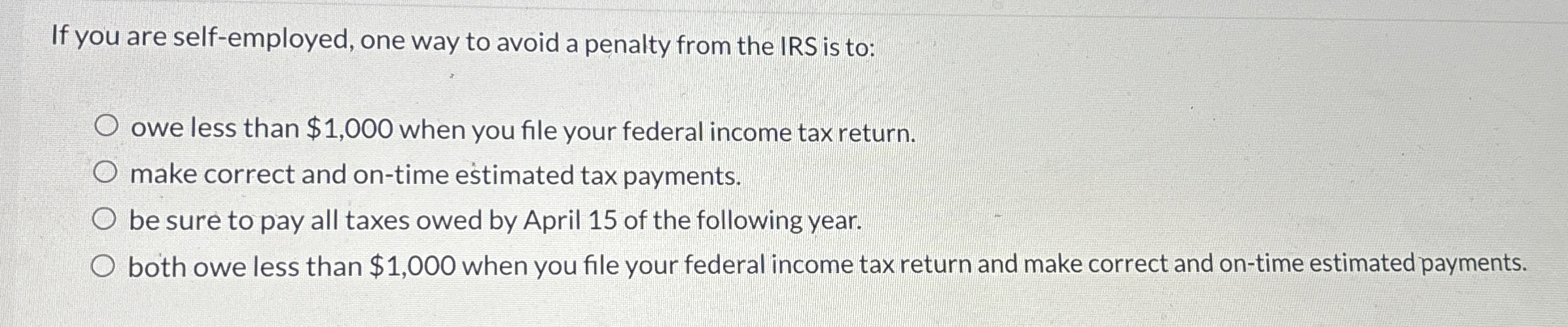

If you are selfemployed, one way to avoid a penalty from the IRS is to:

owe less than $ when you file your federal income tax return.

make correct and ontime estimated tax payments.

be sure to pay all taxes owed by April of the following year.

both owe less than $ when you file your federal income tax return and make correct and ontime estimated payments.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock