Question: If you can answer both questions will like and comment 19. A five year project requires an initial asset investment of $300,000. The fixed asset

If you can answer both questions will like and comment

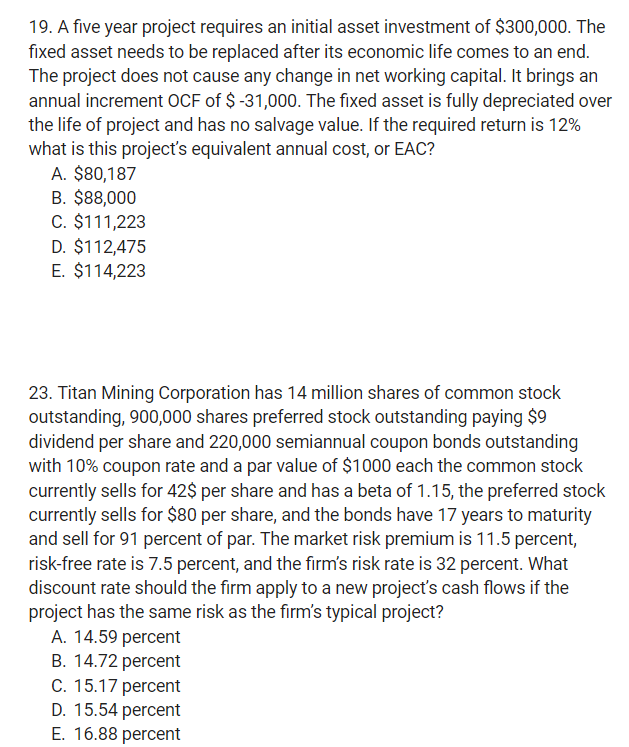

19. A five year project requires an initial asset investment of $300,000. The fixed asset needs to be replaced after its economic life comes to an end The project does not cause any change in net working capital. It brings an annual increment OCF of $-31,000. The fixed asset is fully depreciated over the life of project and has no salvage value. If the required return is 12% what is this project's equivalent annual cost, or EAC? A. $80,187 B. $88,000 C. $111,223 D. $112,475 E. $114,223 23. Titan Mining Corporation has 14 million shares of common stock outstanding, 900,000 shares preferred stock outstanding paying $9 dividend per share and 220,000 semiannual coupon bonds outstanding with 10% coupon rate and a par value of $1000 each the common stock currently sells for 42$ per share and has a beta of 1.15, the preferred stock currently sells for $80 per share, and the bonds have 17 years to maturity and sell for 91 percent of par. The market risk premium is 11.5 percent, risk-free rate is 7.5 percent, and the firm's risk rate is 32 percent. What discount rate should the firm apply to a new project's cash flows if the project has the same risk as the firm's typical project? A. 14.59 percent B. 14.72 percent C. 15.17 percent D. 15.54 percent E. 16.88 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts