Question: If you can solve it in excel, please provide formula details, or provide math solution, thank you. Consider the following nancial data for NCR. US

If you can solve it in excel, please provide formula details, or provide math solution, thank you.

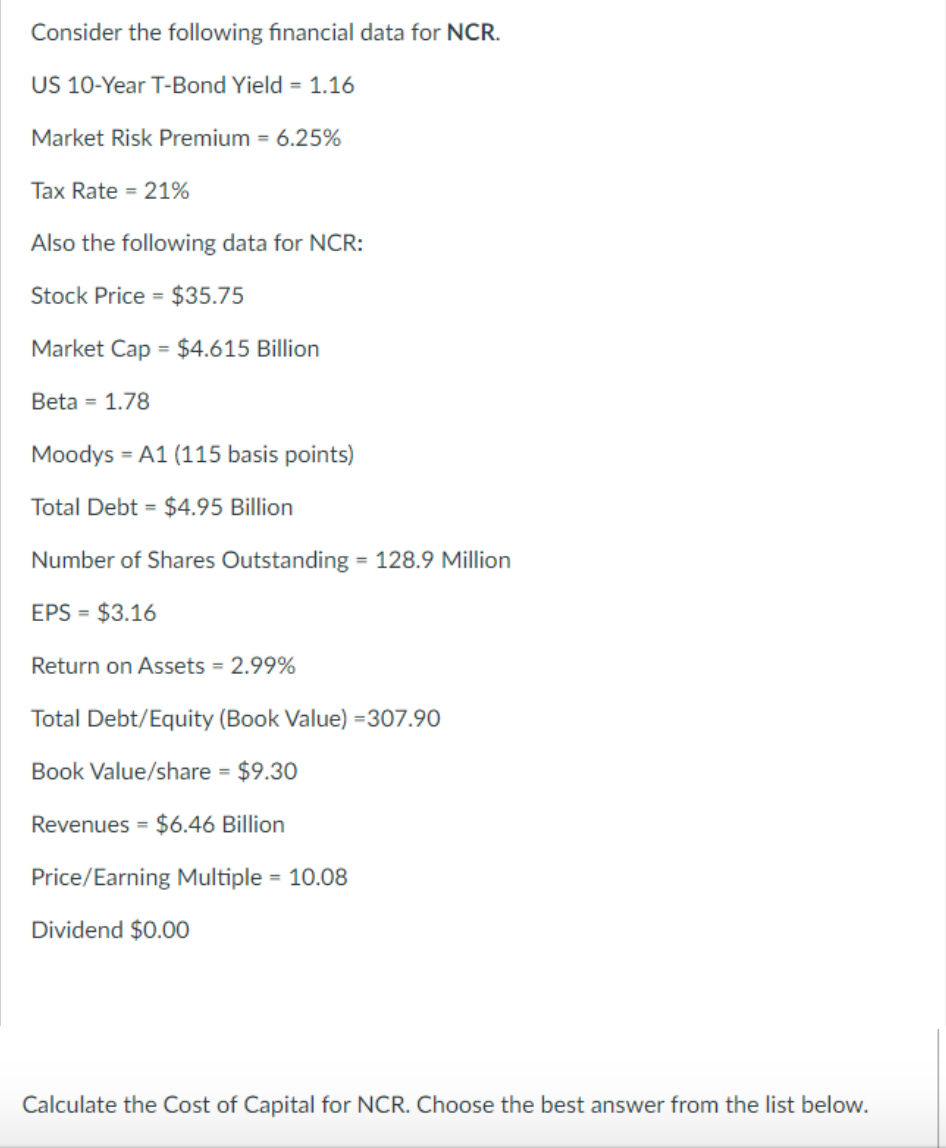

Consider the following nancial data for NCR. US 10-Year T-Bond Yield = 1.16 Market Risk Premium = 6.25% Tax Rate = 21% Also the following data for NCR: Stock Price = $35.75 Market Cap = $4.615 Billion Beta = 1.78 Moodys = A1 (115 basis points) Total Debt = $4.95 Billion Number of Shares Outstanding - 123.9 Million EPS = $3.16 Return on Assets = 2.99% Total Debt! Equity (Book Value) =307.90 Book Value/share = $9.30 Revenues = $6.46 Billion Price/ Earning Multiple = 10.08 Dividend $0.00 Calculate the Cost of Capital for NCR. Choose the best answer from the list below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts