Question: If you can solve it in excel, please provide formula details, or provide math solution, thank you. In January 2019 Ninja Ranger Compacting purchased and

If you can solve it in excel, please provide formula details, or provide math solution, thank you.

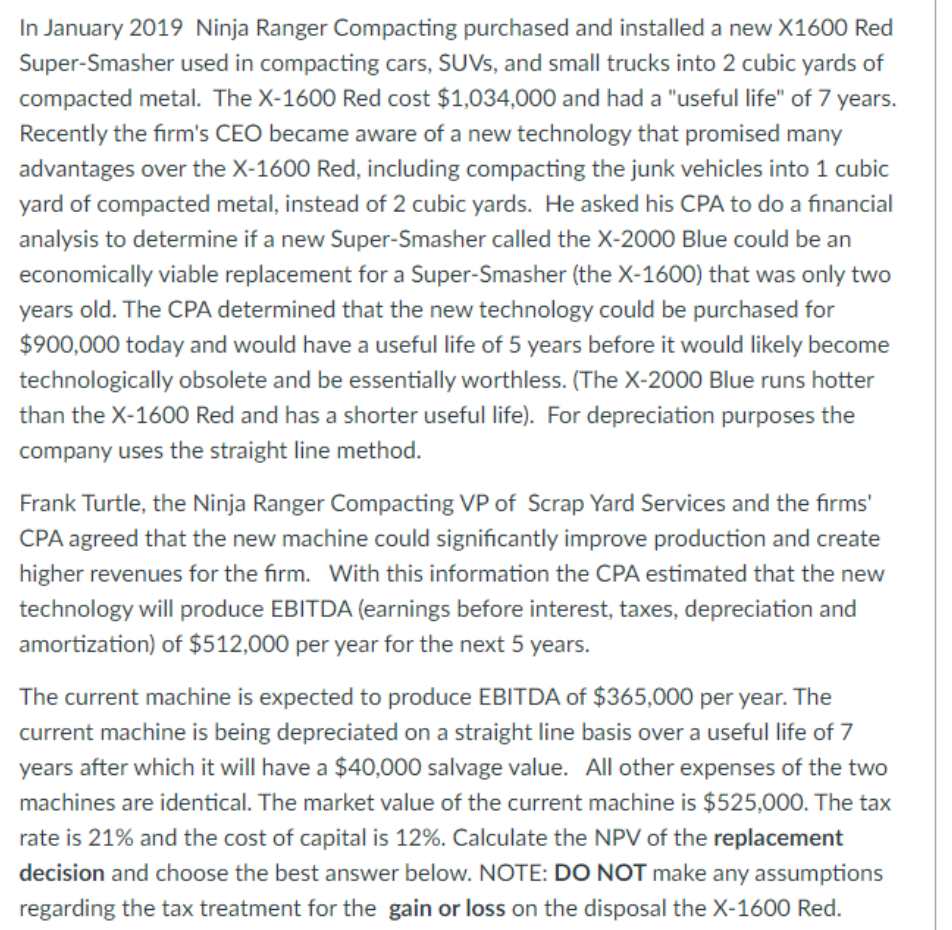

In January 2019 Ninja Ranger Compacting purchased and installed a new X1600 Red Super-Smasher used in compacting cars, SUVs, and small trucks into 2 cubic yards of compacted metal. The X-1600 Red cost $1,034,000 and had a "useful life" of 7 years. Recently the rm's CEO became aware of a new technology that promised many advantages over the X-1600 Red, including compacting the junk vehicles into 1 cubic yard of compacted metal, instead of 2 cubic yards. He asked his CPA to do a nancial analysis to determine if a new Super-Smasher called the X-2000 Blue could be an economically viable replacement for a Super-Smasher (the X-1600) that was only two years old. The CPA determined that the new technology could be purchased for $900,000 today and would have a useful life of 5 years before it would likely become technologically obsolete and be essentially worthless. (The X-2000 Blue runs hotter than the X-1600 Red and has a shorter useful life). For depreciation purposes the company uses the straight line method. Frank Turtle, the Ninja Ranger Compacting VP of Scrap Yard Services and the rms' CPA agreed that the new machine could signicantly improve production and create higher revenues for the rm. With this information the CPA estimated that the new technology will produce EBlTDA [earnings before interest, taxes, depreciation and amortization) of $512,000 per year for the next 5 years. The current machine is expected to produce EBITDA of $365,000 per year. The current machine is being depreciated on a straight line basis over a useful life of 7 years after which it will have a $40,000 salvage value. All other expenses of the two machines are identical. The market value of the current machine is $525,000. The tax rate is 21% and the cost of capital is 12%. Calculate the NPV of the replacement decision and choose the best answer below. NOTE: DO NOT make any assumptions regarding the tax treatment for the gain or loss on the disposal the X4600 Red

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts