Question: If you cannot answer all questions the please do not answer at all, thanks! If you cannot answer all questions the please do not answer

If you cannot answer all questions the please do not answer at all, thanks!

If you cannot answer all questions the please do not answer at all, thanks!

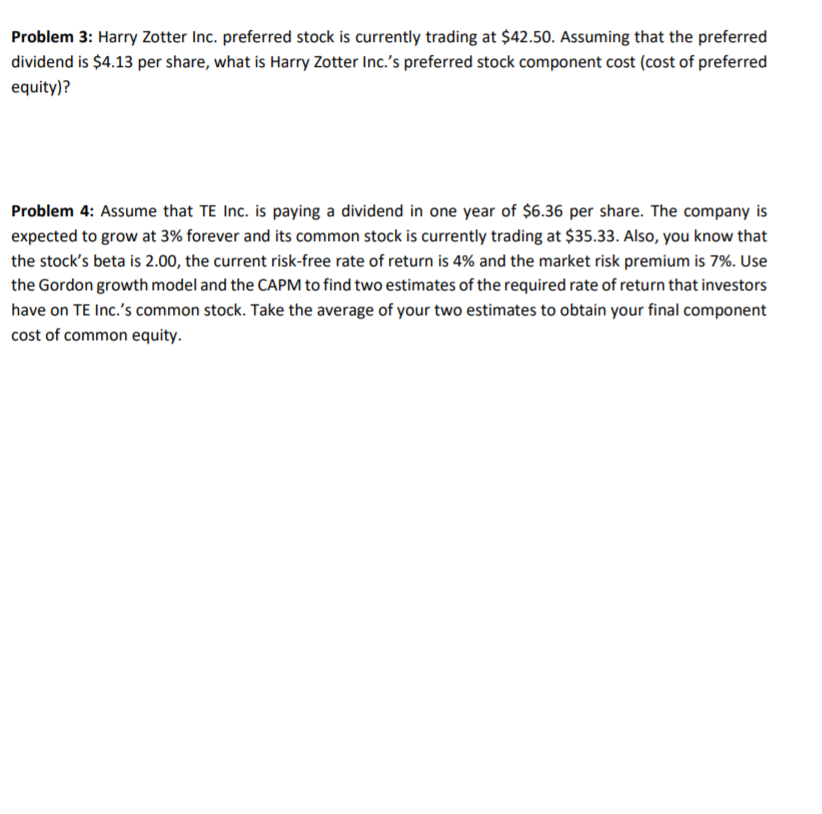

Problem 3: Harry Zotter Inc. preferred stock is currently trading at $42.50. Assuming that the preferred dividend is $4.13 per share, what is Harry Zotter Inc.'s preferred stock component cost (cost of preferred equity)? Problem 4: Assume that TE Inc. is paying a dividend in one year of $6.36 per share. The company is expected to grow at 3% forever and its common stock is currently trading at $35.33. Also, you know that the stock's beta is 2.00, the current risk-free rate of return is 4% and the market risk premium is 7%. Use the Gordon growth model and the CAPM to find two estimates of the required rate of return that investors have on TE Inc.'s common stock. Take the average of your two estimates to obtain your final component cost of common equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts