Question: If you cannot answer all questions the please do not answer at all, thanks! Problem 1: Doodle Manufacturing Inc. has the following debt Loan A

If you cannot answer all questions the please do not answer at all, thanks!

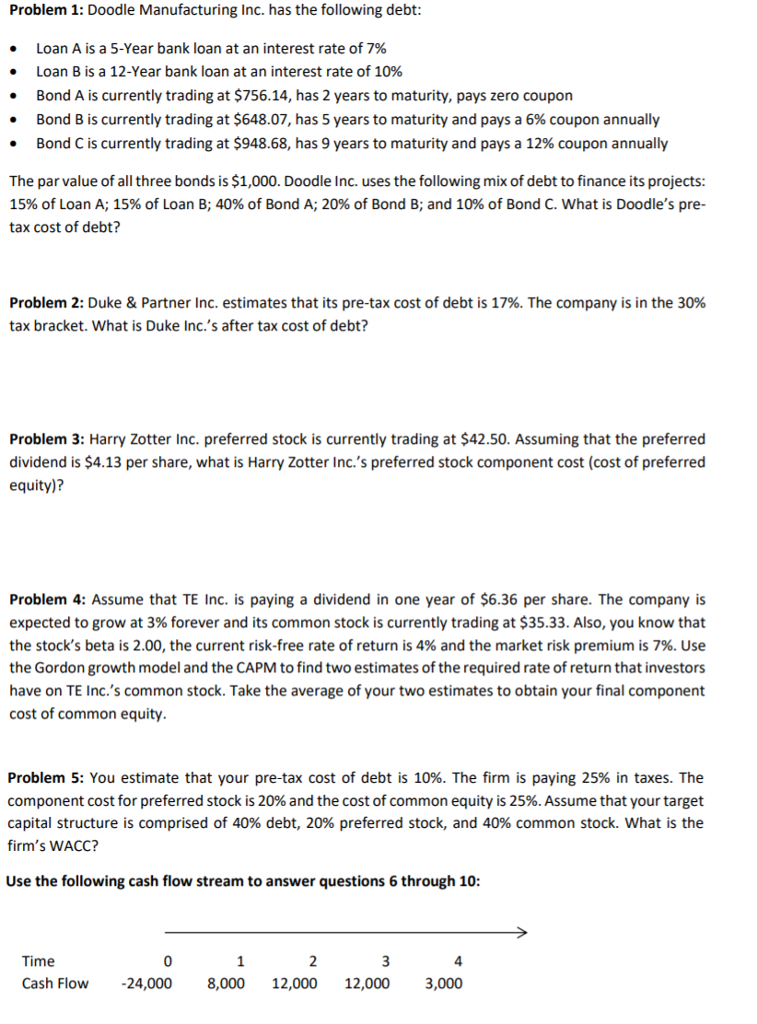

Problem 1: Doodle Manufacturing Inc. has the following debt Loan A is a 5-Year bank loan at an interest rate of 7% Loan B is a 12-Year bank loan at an interest rate of 10% Bond A is currently trading at $756.14, has 2 years to maturity, pays zero coupon Bond B is currently trading at $648.07, has 5 years to maturity and pays a 6% coupon annually Bond C is currently trading at $948.68, has 9 years to maturity and pays a 12% coupon annually The par value of all three bonds is $1,000. Doodle Inc. uses the following mix of debt to finance its projects: 15% of Loan A; 15% of Loan B; 40% of Bond A; 20% of Bond B, and 10% of Bond C. what is Doodle's pre- tax cost of debt? Problem 2: Duke & Partner Inc. estimates that its pre-tax cost of debt is 17%. The company is in the 30% tax bracket. What is Duke Inc.'s after tax cost of debt? Problem 3: Harry Zotter Inc. preferred stock is currently trading at $42.50. Assuming that the preferred dividend is $4.13 per share, what is Harry Zotter Inc.'s preferred stock component cost (cost of preferred equity)? Problem 4: Assume that TE Inc. is paying a dividend in one year of $6.36 per share. The company is expected to grow at 3% forever and its common stock is currently trading at $35.33. Also, you know that the stock's beta is 2.00, the current risk-free rate of return is 4% and the market risk premium is 7%. Use the Gordon growth model and the CAPM to find two estimates of the required rate of return that investors have on TE Inc.'s common stock. Take the average of your two estimates to obtain your final component cost of common equity Problem 5: You estimate that your pre-tax cost of debt is 10%. The firm is paying 25% in taxes. The component cost for preferred stock is 20% and the cost of common equity is 25%. Assume that your target capital structure is comprised of 40% debt, 20% preferred stock, and 40% common stock. what is the firm's WACC? Use the following cash flow stream to answer questions 6 through 10 Time 4 Cash Flow 24,000 8,000 12,000 12,000 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts