Question: please help me solve this Question 1 2 pts . Doodle Manufacturing Inc. has the following debt: Loan A is a 5-year bank loan at

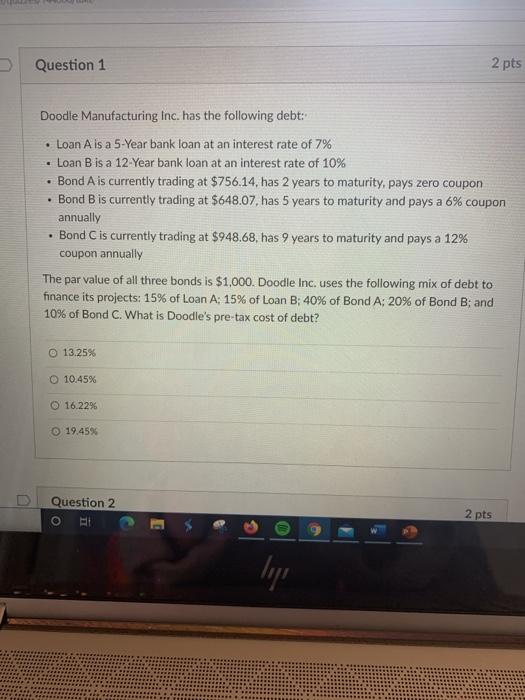

Question 1 2 pts . Doodle Manufacturing Inc. has the following debt: Loan A is a 5-year bank loan at an interest rate of 7% Loan B is a 12-Year bank loan at an interest rate of 10% Bond A is currently trading at $756.14, has 2 years to maturity, pays zero coupon Bond B is currently trading at $648.07, has 5 years to maturity and pays a 6% coupon annually Bond C is currently trading at $948.68, has 9 years to maturity and pays a 12% coupon annually The par value of all three bonds is $1,000. Doodle Inc. uses the following mix of debt to finance its projects: 15% of Loan A: 15% of Loan B: 40% of Bond A: 20% of Bond B; and 10% of Bond C. What is Doodle's pre-tax cost of debt? 13.25% 10.45% @ 16 2296 19.45% Question 2 2 pts loy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts