Question: if you cant answer both please answer 1 and explain how to do the other 15. One Point Corp. has a $1,000 par value bond

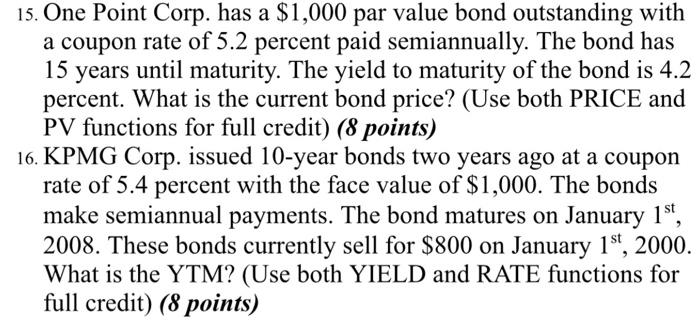

15. One Point Corp. has a $1,000 par value bond outstanding with a coupon rate of 5.2 percent paid semiannually. The bond has 15 years until maturity. The yield to maturity of the bond is 4.2 percent. What is the current bond price? (Use both PRICE and PV functions for full credit) (8 points) 16. KPMG Corp. issued 10-year bonds two years ago at a coupon rate of 5.4 percent with the face value of $1,000. The bonds make semiannual payments. The bond matures on January 1st, 2008. These bonds currently sell for $800 on January 1st, 2000. What is the YTM? (Use both YIELD and RATE functions for full credit) (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts