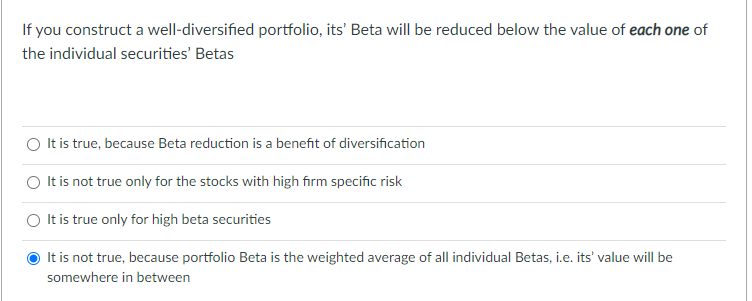

Question: If you construct a well-diversified portfolio, its' Beta will be reduced below the value of each one of the individual securities' Betas It is true,

If you construct a well-diversified portfolio, its' Beta will be reduced below the value of each one of the individual securities' Betas It is true, because Beta reduction is a benefit of diversification It is not true only for the stocks with high firm specific risk It is true only for high beta securities It is not true, because portfolio Beta is the weighted average of all individual Betas, i.e. its' value will be somewhere in between

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts