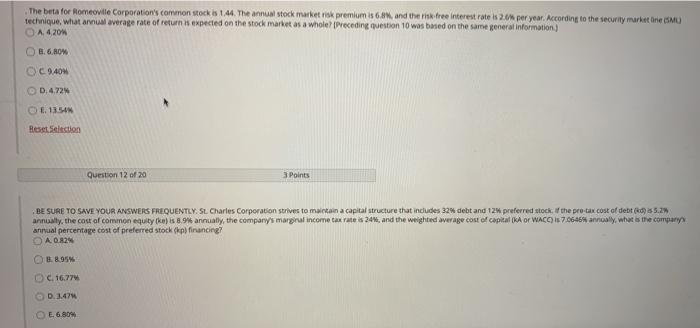

Question: if you could answer both questions, that would be great! The beta for Homeovile Corporation's common stock is 144. The annual stock market risk premium

The beta for Homeovile Corporation's common stock is 144. The annual stock market risk premium is 6.8%, and the risk free interest rate is 2.00 per year. According to the security market line SMU technique, what annual average rate of return as expected on the stock market as a whole preceding question 10 was based on the same general information) A4,20 8.6 RON CC 940N D. 4.72 L. 13.50 Resst Selection Question 12 of 20 3 Points BE SURE TO SAVE YOUR ANSWERS FREQUENTLY. St. Charles Corporation strives to maintain a capital structure that includes 32 debt and 12 preferred stock. If the pro-tax cost of debt (5.2) annually, the cost of common equityk) 8.9% annually, the company's margral income tax rates 24%, and the weighted average cost of capital A Or WACO 13 7.0646% analy, what is the company annual percentage cost of preferred stock in financing O A 0.32% C. 16.774 D.3.478 E. 6.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts