Question: If you could explain how to do these that'd be very helpful, thanks! Special Deductions and Limitations (LO 11.3) In 2022, Citradoria Corporation is a

If you could explain how to do these that'd be very helpful, thanks!

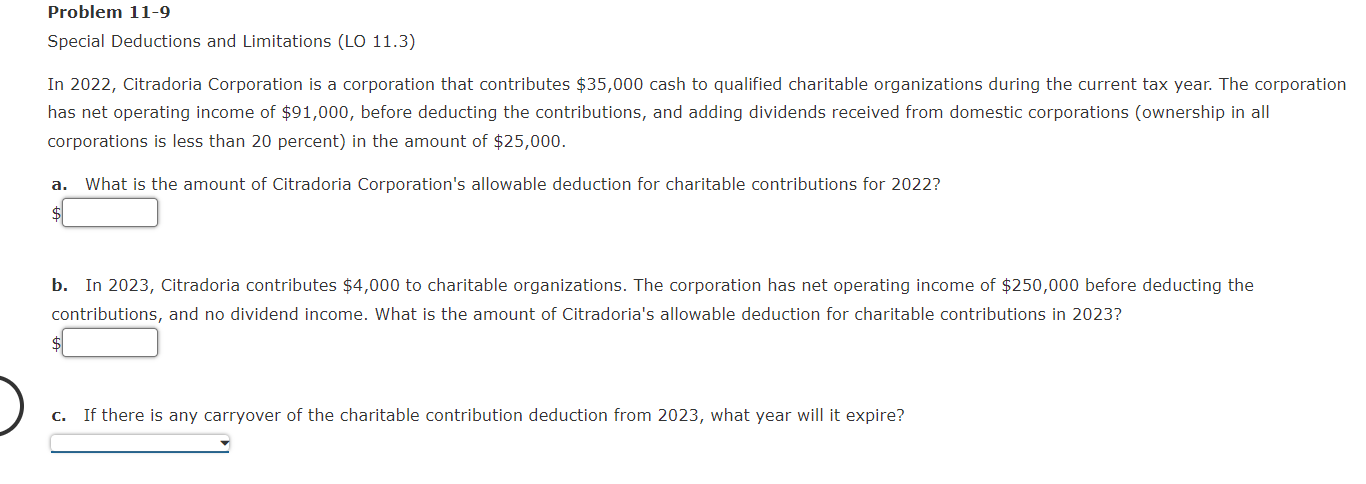

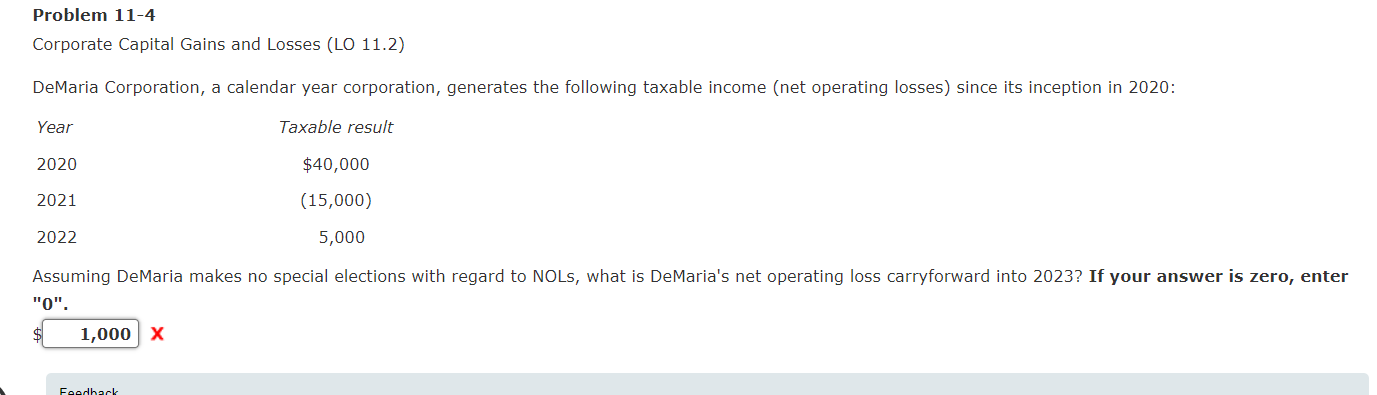

Special Deductions and Limitations (LO 11.3) In 2022, Citradoria Corporation is a corporation that contributes $35,000 cash to qualified charitable organizations during the current tax year. The corporation has net operating income of $91,000, before deducting the contributions, and adding dividends received from domestic corporations (ownership in all corporations is less than 20 percent) in the amount of $25,000. a. What is the amount of Citradoria Corporation's allowable deduction for charitable contributions for 2022? $ b. In 2023, Citradoria contributes $4,000 to charitable organizations. The corporation has net operating income of $250,000 before deducting the contributions, and no dividend income. What is the amount of Citradoria's allowable deduction for charitable contributions in 2023? $ c. If there is any carryover of the charitable contribution deduction from 2023, what year will it expire? Problem 11-4 Corporate Capital Gains and Losses (LO 11.2) DeMaria Corporation, a calendar year corporation, generates the following taxable income (net operating losses) since its inception in 2020: Assuming DeMaria makes no special elections with regard to NOLs, what is DeMaria's net operating loss carryforward into 2023? If your answer is zero, enter "0". \& X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts